New Zealand's two biggest news publishers want to merge and they have submitted their application for the competition watchdog's approval. Mediawatch looks at the case they have put forward.

“The merger of many of New Zealand's leading news brands into one multimedia company may seem a hard pill to swallow, but it will not remove competition between different titles and modes of news or the diversity of voices and views.”

So said the New Zealand Herald last weekend in an editorial which assured readers: “Better and stronger media in New Zealand is on the cards.”

The “leading news brand” driving the merger is the Herald’s owner NZME. The application sent to the Commerce Commission last Friday was on NZME letterhead, and signed by its chief executive Michael Boggs.

The company it wants to merge with is Fairfax Media, the biggest publisher of papers and and online news in New Zealand - indeed the only other company of national significance in the same market.

NZME had previously pursued listing on the stock exchange and a subscription ‘paywall’ to make money from online readers. Both plans were abandoned after lukewarm responses.

A merger with Fairfax, struggling with the same business problems, is the next - possibly the only remaining - option.

Desperate measures?

The National Business Review's Chris Keall said applications for merger approval “are an exercise in abject humiliation” because companies are obliged to paint a bleak picture of their prospects alone in the market.

Applications usually consider the “counterfactual,” setting out what the companies believe will happen if the proposed merger transaction is not cleared. Most of that part of the Fairfax / NZME application is redacted from the version that was made public.

What's the counterfactual? Photo: screenshot

But judging by the extensive description of the terrible outlook for traditional news publishing that is in the application, you can imagine it doesn’t foresee a happy ending for either company.

Cornering the market?

On the face of it, one outfit owning both companies’ newspapers, radio stations, magazines, websites and advertising platforms appears fundamentally anti-competitive.

But the 129-page application to the Commerce Commission (PDF) - backed up with another report commissioned from consultants NERA (PDF) - strongly argues there is "no material overlap" between their respective New Zealand publishing businesses.

“In paid daily papers, in almost every New Zealand region there is only one masthead, because consumers have already picked their winner,” the document points out.

True up to a point. But in many places one company simply surrendered to the other, so the forerunners of NZME and Fairfax ended up holding their own agreed turf. In the South Island, NZME sold all its papers to local owners in 2013.

The merger application does concede that their two dominant news websites - stuff.co.nz and nzherald.co.nz - do overlap, (something regular readers of both will also have noticed in terms of the content).

But whether rivals or not, Fairfax and NZME say they both compete for their critical advertising revenue with a growing number of other digital media companies these days.

In fact, the document lists almost every media outlet you could think of - both local and global - as either an actual and potential competitor, including blog sites with hardly any advertising at all.

In an alphabetical list of competitors, the huge US-based online business Pinterest is followed by the Pohutakawa Coast Times, which serves 5,000 readers south-east of Auckland.

It also says the owners of Dunedin-based Allied Press have a “personal wealth estimated at $70 million” and could expand beyond its lower South Island area, but it’s hard to see how it could even if the “big two” don’t merge.

But smaller media companies are hardly the main threat.

Where the online money is going

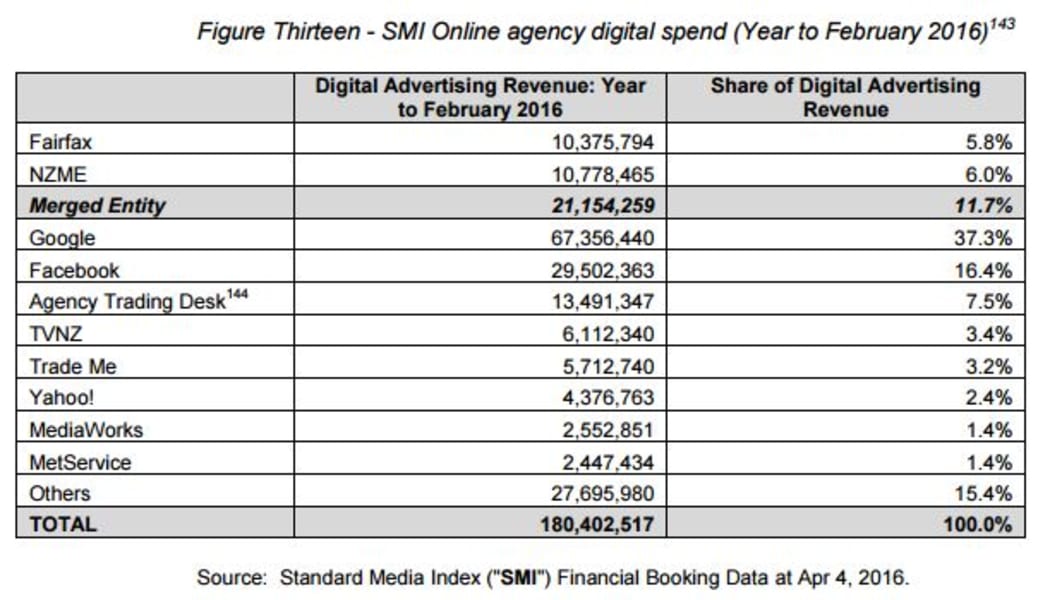

A series of charts in the merger document show newspapers' ad revenue slumping in the past ten years, both here and overseas. At the same time, revenue from digital advertising (ads hosted on websites and social media and apps) has steadily climbed and surpassed it.

This suggests the market has substituted one medium for the other, but a startling table shows the lion’s share of the new digital revenue is not being gobbled up by NZ media companies.

Google and Facebook combines get 54% of the revenue from digital ads in New Zealand. By contrast, Mediaworks - owner of TV3 and half of this county’s radio stations - only gets the same online income as Metservice.

The merger application tells the Commerce Commission a merged Fairfax and NZME would only pull in 11% of the digital revenue.

A chart in the merger application showing where the revenue from digital advertising is going. Photo: screenshot

That’s hardly cornering the market, but the combined total excludes the money both companies get from ads sold by KPEX. This is a joint initiative set up with TVNZ and MediaWorks - a venture which shows there are ways to compete and co-operate other than merging with rivals.

Giving up on making punters pay online

The merger application says “it is hard to charge for content when so much is easily accessible through social media platforms”. It says the bulk of income will be from digital advertising in the future.

It is also harder for local media to sell ads for their own digital platforms because people are increasingly getting news content shared by other people on social media feeds instead.

To illustrate this, The NERA report says visits to The New York Times website fell by half between 2011 and 2013. But it doesn’t say that 2011 was the year The New York Times put up a paywall which now produces the majority of its revenue.

Fortune magazine says it is "arguably the media’s most successful media paywall", though Fortune also says it should not be used as a benchmark elsewhere.

Will the content be as good?

While pundits have predicted as many as 300 journalists may be surplus to requirements if the Fairfax / NZME merger goes ahead, the merger application insists:

"The quality of news and information content will be improved by the ability of the merged entity to invest in quality editorial content (that will) differentiate its digital offering from other media".

But surely the same incentive should already be at work at those companies today. Even if the merger brings an end to “the clickbait war” they’re now fighting online, they may still be engaged in the same battle with other media.

A Commerce Commission decision is due in August and Fairfax and NZME want the merger in place by the end of the year. However, clearance for some recent mergers has taken a lot longer and the Commission will also consider submissions on the merger from June.

Other media companies are likely to raise objections - and some concerned citizens too.

Will it get a green light?

The NBR’s Tim Hunter says only five applications have been declined since 2011, while more than 50 have been approved. But while NZME and Fairfax claimed their businesses were complementary, he disagrees.

“This is, to a large extent, bollocks,” he wrote in the NBR recently.

Their papers may not compete much in the same areas any more, he said, but both now have news operations structured to serve national online news websites - and in NZME’s case, radio networks as well.

The online audience for each company far exceeds those of TVNZ and MediaWorks, he said. Of the websites which outrank those on Fairfax and NZME, none actually produce news.

“A merged entity will still face declining print advertising and defeat by new players online”, he said, and it will also make a paywall more likely.

The Commerce Commission may conclude the merger “will define the market for online journalism and emphasise their dominance,” he said.

However, in the Herald on Sunday columnist Paul Little noted a seemingly unstoppable trend towards monopoly in all areas of commerce” already includes the media here.

“We already have a near total dominance of the magazine market by Bauer Media, which owns most major local titles and would almost certainly like to own the few that belong to Fairfax and rats and mice publishers,” he wrote.

We have allowed this trend “to sneak up on us,” he says - because of the internet.

Trade Me remains popular, he said, even though it’s completely dominant. Likewise, Facebook acquired Instragram, Google bought YouTube, Amazon bought Book Depository and now retails almost everything. Consumers don't seem to mind much

Without wasting time and effort on fending off competitors, these big companies can develop better services, he wrote.

But what about keeping prices low?

“Well they could, but most monopolies put their obligation to make a profit before any other aim,” Paul Little concluded.

In the case of Fairfax and NZME, preserving their share of the market and some profitability is the aim right now.

But even a green light for dominance of local online news and newspapers may not be enough to guarantee that in the digital age.