Infometrics economist Matt Nolan says the Reserve Bank will only move on the Official Cash Rate if the European debt crisis escalates.

The central bank reviews the Official Cash Rate on Thursday, and many economists believe the rate will stay at the same level of 2.5%.

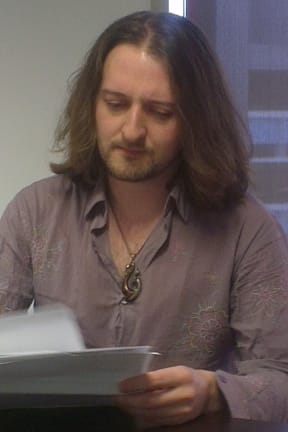

Infometrics economist Matt Nolan. Photo: RNZ

Mr Nolan says with no long-term solution in place for Europe, the economy is in a bit of a holding period, so the Reserve Bank does not have to act yet.

He says it's very likely the bank will keep the rate on hold and it will probably keep signalling that it will be a long time before rates are lifted.

"They'll also make it clear that it's very unlikely they'll cut rates unless there's a big financial crisis, unless things in Europe really go wrong".

Mr Nolan says Europe is likely to continue 'muddling along', with problems getting shunted to the side. This means there is no need for the Reserve Bank to respond.

Mr Nolan says with rates where they are, the Reserve Bank is supporting the economy at a time when Government spending is pulling back, incomes are falling because the terms of trade is dropping back and the exchange rate is very high reducing exporters' income.

Mr Nolan says some economists believe inflation is a potential risk because New Zealand doesn't have the capacity to produce that it might have had in the past, so as soon as the Canterbury rebuild gets underway there will be inflation.

"That isn't our view ...I feel like there is spare capacity there, that New Zealand can increase its output without worrying about inflation and the Reserve Bank in its own forecast is going along with that view as well".