Mighty River Power is indicating electricity prices could come down on the back of a big profit rise.

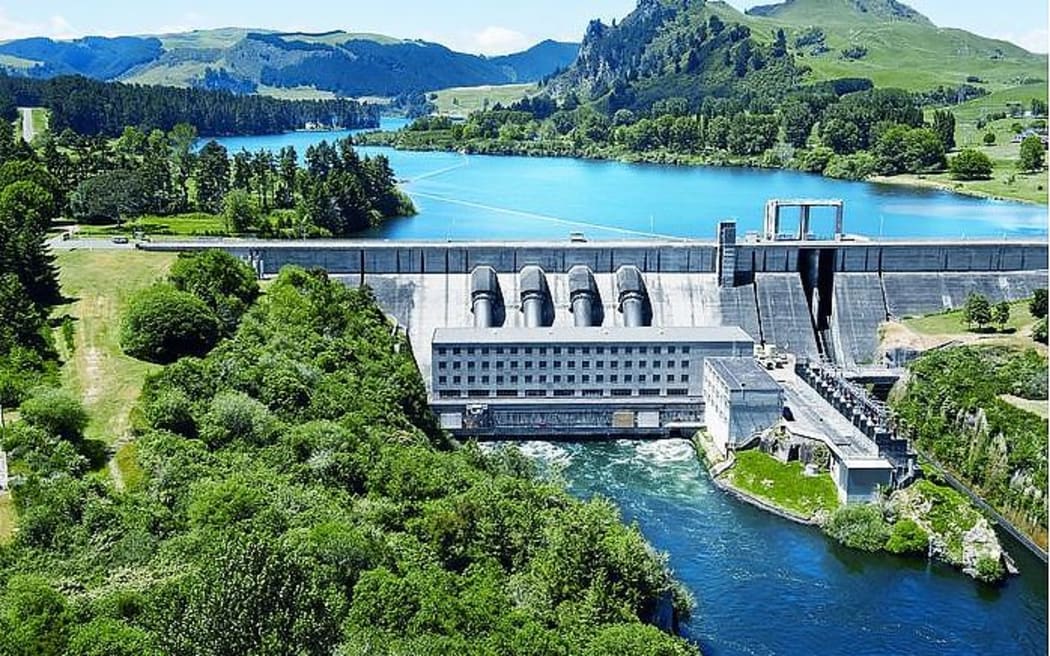

Mighty River's net profit of $212 million easily beat the prospectus forecast of $160 million. Photo: MIGHTY RIVER POWER

The company today announced an annual net profit of $212 million, up 84 percent on last year's result, reflecting the contribution of its new Ngatamariki geothermal power station.

Labour's energy spokesperson David Shearer said the rise was outrageous and came amid flat or declining demand, with other power companies also posting record profits.

But Mighty River Power chair Joan Withers said the result was achieved in a year marked by highly competitive customer pricing and, at the very least, bills would not be going up.

"Demand is not increasing and it's incredibly competitive when you've got the number of retail operators in the market," she said.

"Absolutely I can see the possibility of retail pricing coming back."

Mr Shearer said the current electricity system was failing ordinary New Zealanders.

David Shearer Photo: LABOUR PARTY

"I've had many, many Kiwis get in contact with me and say that their power bills have gone through the roof. Today we hear that Mighty River Power has made a profit increase of 84 percent, and I just think that's outrageous."

Mr Shearer said if elected to government, Labour would introduce a new body to regulate power prices.

This follows reports earlier this week of Meridian Energy's underlying annual earnings rising 20 percent to $194 million and Contact Energy's rising 12 percent to $227 million.

Business journalist Rod Oram said he could not understand why power prices had not come down already but suggested the wholesale market could be responsible.

"It comes back to this question of 'why is the wholesale market not throwing up lower prices and why do we not see those low prices come through at the retail level as well'."

Mighty River Power beats forecast

Mighty River Power's annual net profit of $212 million for the year ended June easily beat the prospectus forecast of $160 million.

Contributing to the higher result were lower interest costs, lower capital spending and a lower tax bill compared with the prospectus forecasts.

The operating profit was up 29 percent and was just 1 percent ahead of the prospectus forecast.

The government-controlled electricity generator and retailer, which listed on the NZX in May last year, will pay a final dividend of 13.5 cents per share, above the forecast 13 cents.