A possible listing of Carter Holt Harvey on the sharemarket is unlikely to result in significant job losses, analysts say.

Market sources have confirmed to Radio New Zealand that Graeme Hart's Rank Group plans to sell up to 60 percent of the company, for up to $1 billion.

A sharemarket float of Carter Holt Harvey would be the final act in a series of sales since Graeme Hart bought the business for $3.6 billion in 2006.

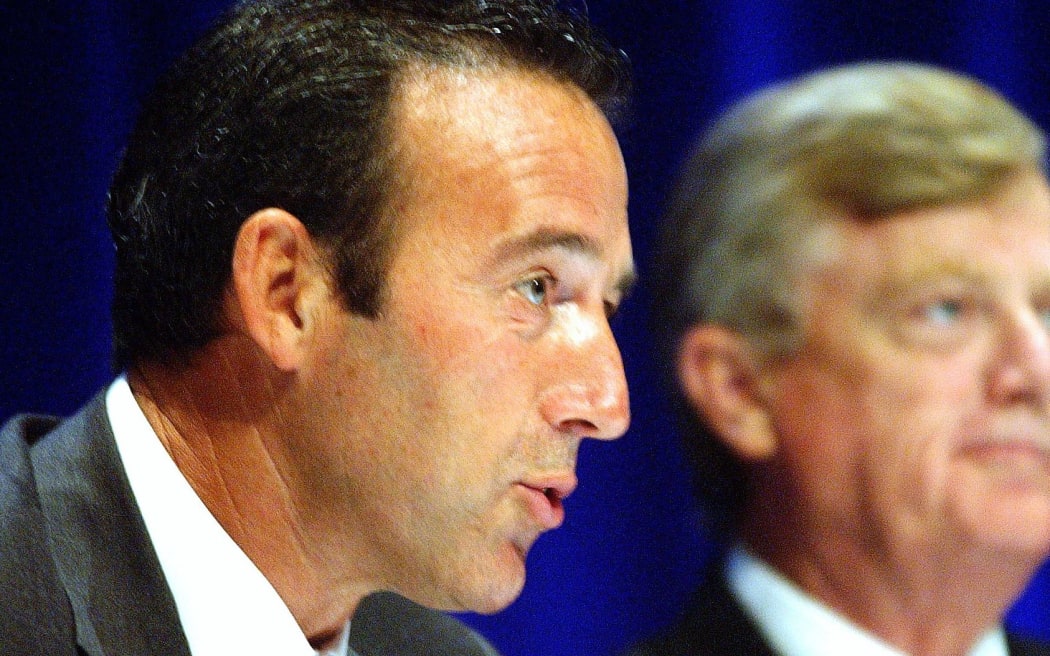

Graeme Hart Photo: AAP / file

Since then, he has sold Carter Holt's forests, its farms and last year, the paper and pulp business, including Kinleith mill in Tokoroa.

Business analyst Rod Oram said the only thing left for Mr Hart to sell was the building supply stores and wood products business.

"Now he has the rump of the business, where there is potentially quite a limited upside, and therefore it's no longer of particular interest to him - so he therefore floats that company on the stockmarket, as he did with Goodman Fielder."

If the shares were priced competitively, that could pique the interest of some investors, Mr Oram said.

But he was very sceptical about how attractive a prospect Carter Holt Harvey would be.

"[Mr] Hart has picked out the best of the business; he's squeezed those assets the best he's going to. Therefore it raises questions about what's really left for new investors."

However, Mr Hart's efficiency drives meant the thousands of employees at Carters building supply stores and wood products brands should not be too worried about the prospect of a sharemarket float, Mr Oram said.

"From an employee point of view, you'd have to think there's not a great deal more that they can do ... It'd be hard to imagine there would be a lot more restructuring still to do."

Mark Lister, of Craigs Investment Partners, said any new shareholder would be looking for ways to make the business leaner and meaner.

But he too, said wholesale job losses were unlikely.

"Some people would probably suggest that those have already happened.

"And then you think about where the New Zealand economy's going - we're in pretty good shape, construction's doing pretty well, so the economic backdrop probably doesn't lend itself to wholesale redundancies or store closures."

But the Engineering, Printing and Manufacturing Union, which represents many of Carter Holt Harvey's employees, said any sharemarket float would have them concerned.

The union's national timber industry organiser, Ron Angel, said that was because the return to the shareholder would become the main focus of the business.

"The employers start to go, that's [employment conditions] the easiest area or the first area we can cut, they then start to see what bits of the business they can sell off or divide up ... and it's just a never-ending circle down for the workers."

Many of the wood products sites were in rural locations and any job losses would hurt those communities badly, Mr Angel said.

Carter Holt Harvey has not yet confirmed it is planning any sharemarket float.