A defence witness in the South Canterbury Finance trial says the late chairperson Allan Hubbard paid loans down to depict a better financial position for the company.

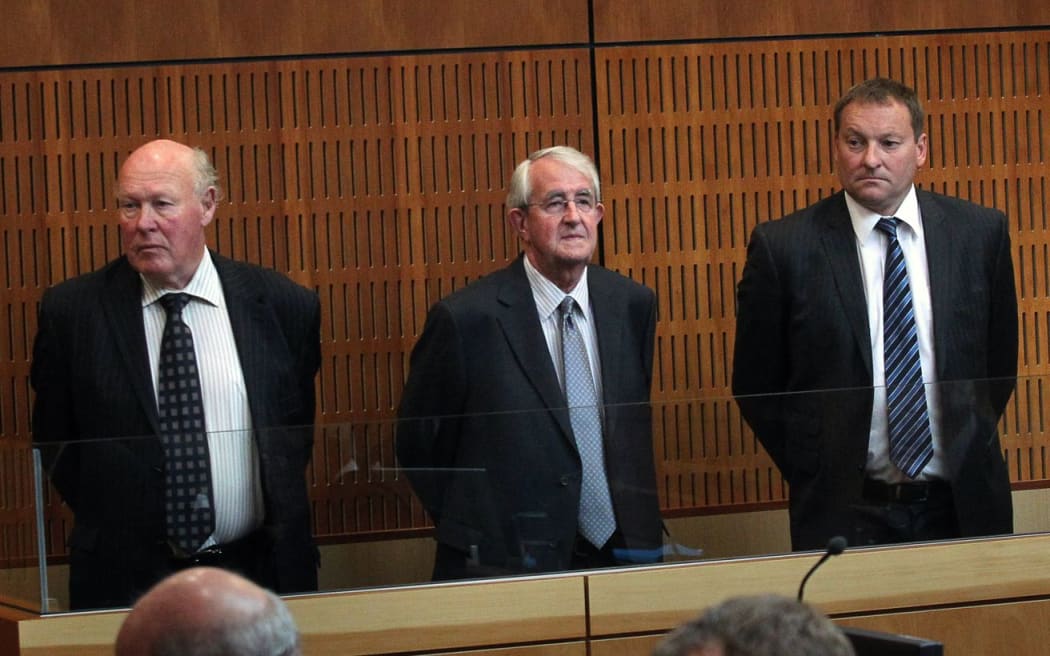

Former directors Edward Sullivan and Robert White, and former chief executive Lachie Mcleod are standing trial for 18 fraud-related charges in the High Court in Timaru.

The company was obliged to disclose to trustees any loans greater than 20 percent of shareholders' funds.

Terence Hutton, a former accountant for South Canterbury Finance, said it had loans above that threshold with Southbury Group, South Island Farm Holdings and Dairy Holdings.

Mr Hutton said Allan Hubbard used his power to make the company's books appear in good shape and did not like disclosing loans it had with related parties.

"It would be a common practice for him to pay down any related party loans that he had the ability to control at the reporting date be it 31 September or 30 June, and then within a few days following the reporting date to draw down that loan again."

Mr Hutton said the loan balance would be reported as zero percent, when it was actually above 20 percent. He said the company's auditors were aware of this, and as far as he was aware had no issue with it.

Mr Hutton said Mr Hubbard would often pay down loans at the end of the financial year, resulting in a zero percent loan balance, when it was actually above 20 percent.

He told the court South Canterbury Finance's auditors were aware of this, and as far as he was aware had no issue with it.

Mr Hutton told the court he never doubted the honesty of Mr Mcleod when dealing with transactions or loans. He said he received various emails from Mr McLeod, and while he thought some of his comments were silly, they were not fraudulent or dishonest.

From left: Edward Sullivan, Robert White and Lachie McLeod. Photo: Mytchall Bransgrove