The last defence witness called to give evidence at the trial of three former South Canterbury Finance directors has defended the business practices of the company.

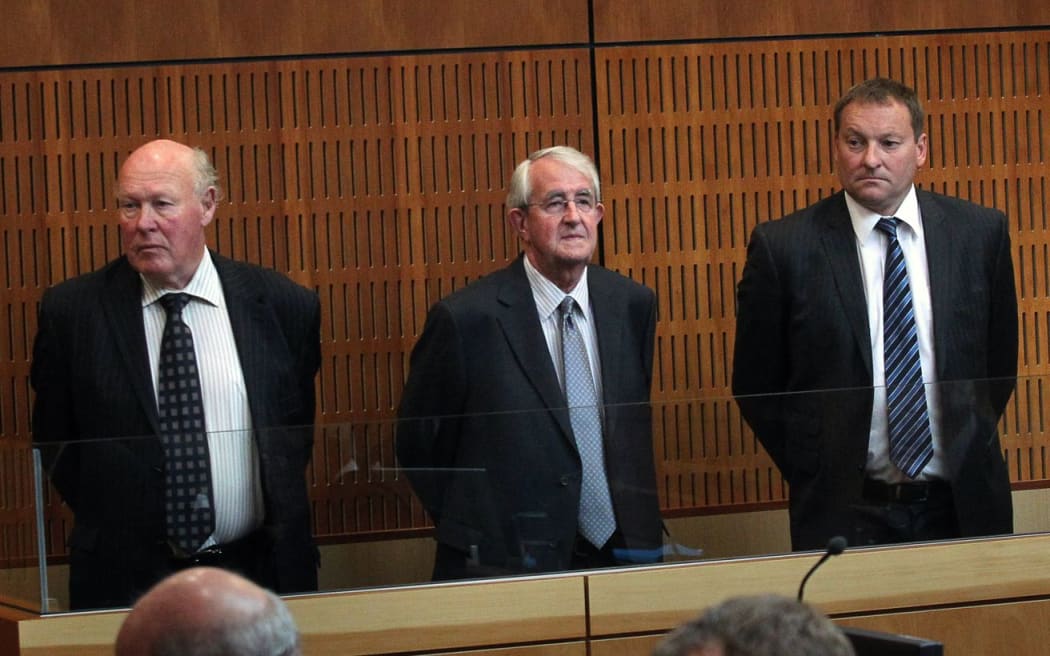

For almost five months, Lachie McLeod, Edward Sullivan and Robert White have been contesting 18 fraud charges brought by the Serious Fraud Office at the High Court in Timaru.

Forensic accountant John Hagen disputes allegations that the company structured loans in such a way they would not have to be disclosed in prospectuses or any other public documents.

"On the contrary, it is entirely normal for a finance company to structure its lending in a way that protects its position by giving it the best security available in relation to a return on the funds lent," Mr Hagen told the court on Monday.

Companies South Canterbury Finance had transactions with included Shark Wholesalers, Woolpak Holdings, Dairy Holdings Limited and the Hyatt Hotel group.

Mr Hagen said some of the lending between these companies was irrelevant and did not need to be disclosed, and lending was disclosed where necessary.

He said in some cases, the lending was structured to improve the security of South Canterbury Finance and facilitate its ongoing trading opportunities.

The court earlier heard evidence from Grant Graham, an accountant, independent auditor and expert witness for the SFO who said that South Canterbury Finance routinely covered up related party lending.

But John Hagen told the court that lending between various companies was often immaterial when put into context with South Canterbury's total lending and total assets, and Mr Graham was not an expert in this area.

Mr Hagen told the court he agreed that a company called Shark Finance was a related party to South Canterbury Finance. However, he said a loan of $166,000 between the two companies was immaterial when put in the context of the company's total lending in the relevant period of $578 million and total assets of $738 million.

He said he did not believe the transactions between the companies could be considered undisclosed lending.

From left: Edward Sullivan, Robert White and Lachie McLeod. Photo: Mytchall Bransgrove