The High Court in Wellington has been told an investor who profited from the country's largest ponzi scheme doesn't have the money to repay a liquidator.

The High Court in Wellington Photo: RNZ / Alexander Robertson

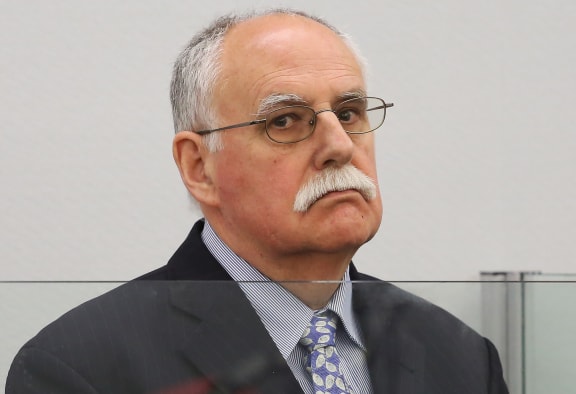

David Ross, 64, was jailed in November 2013 for 10 years and 10 months for operating a fraudulent scheme in which private investors lost millions of dollars.

David Ross Photo: RNZ

The case is the first of three test claims against Ross Asset Management investors who collectively withdrew $3.8 million in fictitious profits.

The liquidator, John Fisk, wants to be able to redistribute their money to investors who lost $115 million when the scheme collapsed in 2012.

Mr Fisk is claiming he has the right under the Property Law Act and the Companies Act to claw back the money from the successful investors.

The liquidator's lawyer, Mike Colson, told the court that in April 2007 the investor, who has name suppression, borrowed $500,000 from a bank and invested it with Ross Asset Management, which was offering returns of 18 percent.

Four and a half years later, when he withdrew his funds from the scheme, he received $954,000.

But the court was told today the investor's money was now tied up in an expensive property deal, which had already cost him more than $300,000 in professional fees, consent fees and demolition costs, and he would lose $1 million if he sold.

His lawyer, Justin Smith QC, said the legisation did not apply to his client, who had always acted in good faith.

In reply, Mr Colson said the court had been provided with evidence relating to the costs of the development but nothing had been received specifying the value of the man's home.

Investors are expected to receive three cents in the dollar and will receive four cents in the dollar if this case is successful.

Justice MacKenzie reserved his decision.