The Reserve Bank is being urged to look at making rural lenders hold more capital against highly indebted farmers.

The central bank said yesterday that it had identified high levels of debt in parts of the dairy sector as a risk to New Zealand's financial system.

This comes as falling dairy prices cut farmers income.

Photo: Supplied

Average operating costs for New Zealand dairy farmers is around $4.50 per kilogram of milk solids, according to Rabobank. This would leave no money to service debt for some farmers.

Reserve Bank govenor Graeme Wheeler said at the current forecast payout of $4.50 per kilo of milk solids, more than 35 percent of farmers will be making a loss.

Mr Wheeler said the dairy sector was critical to the economy, with dairy exports accounting for about a third of merchandise exports.

He said dairy debt has trebled since 2003 to $34 billion.

Don Fraser is a former rural lender with the then-Rural Bank, and in the last 20 years he has provided financial consulting and troubleshooting for farmers.

He said the Reserve Bank should have moved sooner to ramp up the pressure on the sector.

"The Reserve Bank should be requiring the banks to hold more capital against the farmers who are highly indebted.

"If you're at $30 a kilo then the banks should hold more capital against that farm loan because of the level of risk, which would also increase the interest rate, which will put pressure on the farmer not to have so much debt."

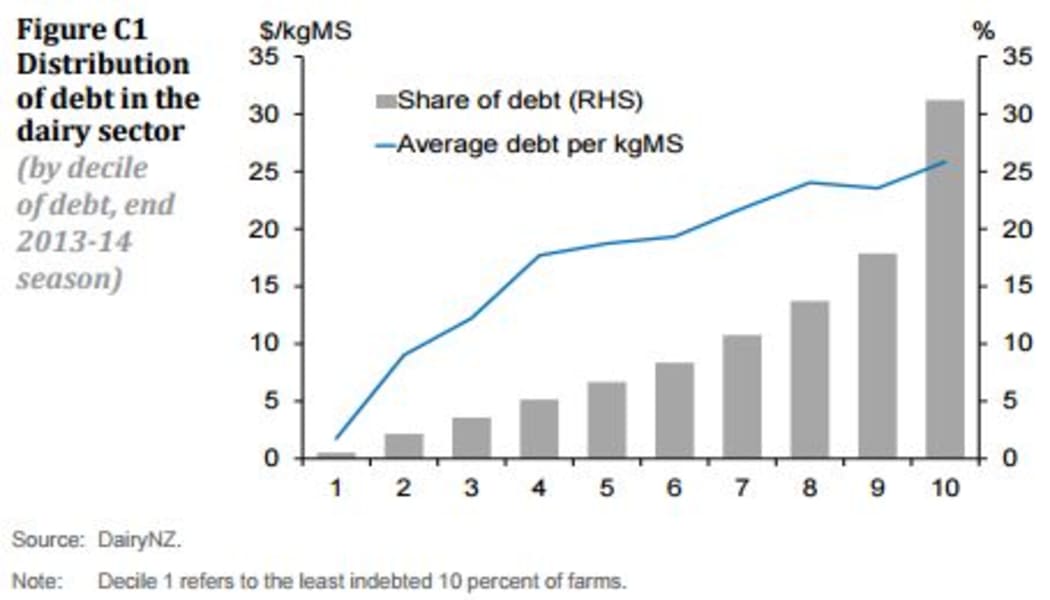

The Reserve Bank said nearly a quarter of dairy debt is owed by farmers with debt in excess of $30 per kilogram of milk solids.

And about 30 percent of dairy debt is concentrated among the most indebted 10 percent of farms.

Photo: AFP

Rabobank is the country's third largest rural lender. Its chief executive Ben Russell said the flipside of those figures was that most farmers are not really highly indebted.

"The average debt in the industry is around $20 per kilogram of milk solids of debt, and we think that's a sustaianable level of debt for most farmers. Some farmers have got considerably higher debt than that.

"Their ability to cope with that depends entirely on their management capability."

Mr Russell said there were a small percentage of farmers where this season could be the tipping point.

"It pushes them into a situation where their debt really becomes unsustainable for the long term and they can't really trade their way out of it.

"Now we look through our portfolio pretty carefully in the ordinary course of events, and at a time like this we look again - yeah, we've got a small number of clients who may be in that situation. Other banks will have similar situations."

Mr Russell said many farmers paid off debt following the recent high payouts, and he believed there would be a rebalancing of supply and demand in late 2015, and a steady price recovery after that.

The Reserve Bank said the financial stress for farmers would be exacerbated if low milk prices led to falling rural land prices.

But PGG Wrightson's general manage of Real Estate, Peter Newbold, said rural land prices peaked and have flatlined at a high price over the last year. He believes prices will remain stable.

"I don't think you're going to see a big correction with the amount of stock that's available, the interest rates that are being offered and the way people are looking at rural.

"If you look out over the next five, ten, fifteen years, it's a very positive space."