EXCLUSIVE - Panama Papers NZ - New Zealand is at the heart of a tangled web of secretive shelf companies and obscure trusts being used by well-heeled South Americans to organise their private wealth, business affairs, and channel their funds around the world.

Photo: RNZ / James Sanday

The extent of this country's involvement in the global money-go-round and intricate asset management and protection industry is showcased by more than 61,000 documents in the leak of papers from the Panamanian law firm Mossack Fonseca - known as the Panama Papers.

The Consortium of Investigative Journalists and German newspaper Süddeutsche Zeitung gave RNZ News, One News, and investigative journalist Nicky Hager joint access to the papers. This is the first in a series of reports on what has been uncovered so far, after only a week with the data.

It is already clear that Mossack Fonseca ramped up its interest in using New Zealand as one of its new jurisdictions in 2013, along with Belize in Central America, offering extremely private, zero-tax foreign trusts.

The firm trumpeted New Zealand's top flight legal and financial reputation as "allowing for the speedy formation of appropriate mechanisms for wealth protection, inheritance and tax planning".

That's code for tax havens, and a Mossack Fonseca memo said 95 percent of the company's work consisted of "selling vehicles to avoid taxes".

New Zealand - A haven in the South Seas. Photo: 123RF

Mossack Fonseca wasted no time setting up the local Auckland branch in December 2013 and from then on enthusiastically chased business, particularly from Mexico, but also from Uruguay, Chile, Brazil and Ecuador.

New Zealand's tax-free status, high levels of confidentiality, and legal security are seen as the virtues, but a common thread through Mossack Fonseca is the need to avoid any structure or involve people who will attract attention from our authorities.

Initially its business was done through an Auckland accountancy firm Staples Rodway, with the main contact being Roger Thompson.

But by mid-2014 Mr Thompson had left Staples Rodway and set up Bentleys Chartered Accountants, on the 13th floor of a Queen Street office tower. Bentleys is the registered office of Mossack Fonseca New Zealand, and Mr Thompson is one of its directors.

Who is Roger Thompson?

Co-founder of Bentleys New Zealand. Director of Mossack Fonseca's subsidiary in New Zealand, and Orion Trust (New Zealand), a trustee company for foreign trust and companies, including members of Malta's government.

Both Mossack Fonseca NZ and Orion Trust use Bentleys address at 205 Queen Street as their registered office.

Roger Thompson Photo: SUPPLIED / Bentleys

Mr Thompson has more than 30 years experience both as a chartered accountant and a lawyer.

His LinkedIn profile says he worked for Staples Rodway, where he also worked closely with Mossack Fonseca, before co-founding Bentleys in August 2014.

His resume also includes stints at Inland Revenue in the early 1980s, also Allan Hawkin's Equiticorp and law firm Kensington Swan.

How does it work?

The system is simple and mechanical.

A foreign investor looking to manage their affairs may be referred to Mossack Fonseca's home office in Panama by a private advisor, a bank or another Mossack Fonseca branch.

The firm routes the inquiry to its New Zealand branch, which looks at the options - perhaps a special tax free company, known as a look-through company, a trust, or a limited partnership.

And then it becomes a task for Bentleys and Mr Thompson and his staff to put into force.

But there's a similarity to many of the deals.

Mr Thompson is often the sole New Zealand director of the local companies alongside two Panamanian directors. A further Bentleys company, Orion Trust (New Zealand) Limited, is used over and over as a nominee office holder in foreign trusts and companies.

The trusts set up have anonymous names such as The Eden Trust, The Oslo Trust, The Milfington Trust and the Omicron Trust.

A character check of the original investor is done using a global search machine, while the investors provide a copy of their passport photo and details, and a utility bill such as a power or gas bill to confirm where the person lives. But these details rarely appear in the public documents.

Bentleys then sends a one page IRD 607 Foreign Trust Disclosure form to Inland Revenue once a year for each foreign trust, confirming no tax needs to be paid under New Zealand foreign trustee law.

The extent of Mr Thompson's links to the industry is shown by the more than 4500 Panama paper documents he's listed in, the 3500 mentions of Bentleys, and the more than 9000 mentions of the ubiquitous Orion Trust.

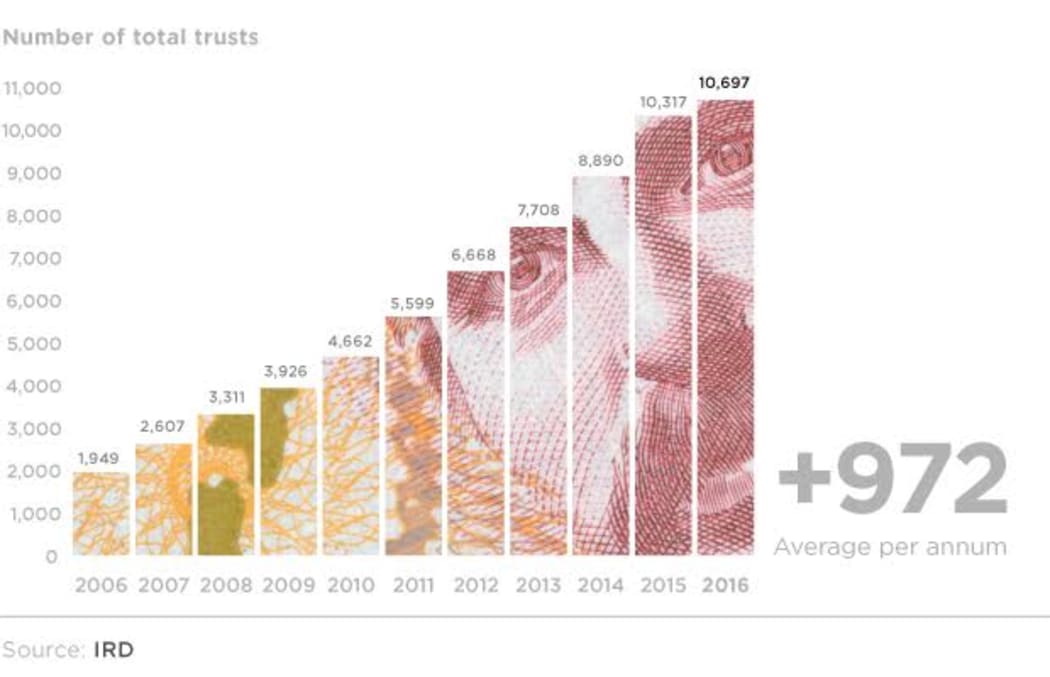

Tax protection - the number of foreign trusts here has multiplied. Graphic: RNZ / James Sanday

But while Bentleys has a dominant role in the industry, similar deals and structures are being constructed by accountants and lawyers throughout the country.

Since the law changes in 2008 and the update in 2011 the number of foreign trusts has more than tripled to 10,697 this year from 3311 - according to Inland Revenue.

The clients

The Panama Papers cast light on the sorts of people using New Zealand.

Typical clients are an Ecuadorian banker, two Colombian car dealers (one New Zealand trust each), a Mexican film director, and wealthy Mexican society figures.

An Israeli man named Asaf Zanzuri, chief executive of the Balam Security company that sells security equipment to various Latin American governments is also in the Papers. In 2015 he negotiated a multi-million dollar contract to supply Dominator XP drones to the Mexican government for use "maintaining Mexico's internal security".

At the same time - February 2015 - Zanzuri used Mossack Fonseca NZ to establish a foreign trust in New Zealand called the Sapphire Trust. Another employee of Balam, Rodriguez Ruiz, also got Mossack Fonseca to set up the Diamond Trust in New Zealand.

Another client taking advantage of New Zealand's opaque structures was Carlos Dorado, the president of Italcambio - a Venezuelan bank. He and a Mexican lawyer, Luis Doporto, set up a New Zealand foreign trust called Abbotsford Trust, which was used in conjunction with a Dutch incorporated company Neuchatel Holdings to buy a Mexican pharmaceutical company.

The papers show a Brazilian mining engineer Bruno Lima looking to use New Zealand structures to run companies exporting chemicals banned in Brazil to Mexico. In the end he abandoned the idea and used the structure to import legal chemicals into Brazil.

And Mexico's unpredictable and uncertain inheritance laws, which can't guarantee family wealth goes to the right people, have been a rich source of business for Mossack Fonseca New Zealand and Bentleys.

Mexico City based Bald Eagle Services run by Michael del Vecchio is described as one of the local Mossack's office best customers, and has sent a steady stream of wealthy Mexicans to set up New Zealand trusts to protect their estates.

Graphic: RNZ / James Sanday

And one of the more intriguing constructions was set up for a Russian-speaking, Spanish based electrical engineer, Jose Ramon Lopez Lombana.

He asked for four New Zealand companies and four New Zealand trusts to be established to deal with four Mexican companies, which pass money and fees from internet trading through New Zealand to a bank account in Prague in the Czech Republic.

The Panama Papers provide a paper trail of deals, but rarely divulge the reasons for the New Zealand trusts and companies or the assets at the centre of the transactions.

Safe haven or tax haven?

The Organisation for Economic Co-operation and Development (OECD), which leads the global fight against tax dodges and money laundering says there are four main characteristics of tax havens:

- little or no tax on a company's income;

- lack of transparency on the ownership and business of a company;

- a company appears to do little or no business;

- and no effective exchange of information between tax authorities.

The government has said New Zealand's adherence to the OECD guidelines, the double taxation and information sharing agreements with scores of countries, and the Inland Revenue's ability to seek information if need be, counter charges of New Zealand being a tax haven.

Roger Thompson rebutted any notion that the trusts and companies his company set up were used to dodge taxes, and said claims they were had been exaggerated.

"I don't see NZ is a tax haven. I would describe it as a high quality jurisdiction for trusts with a benign tax system in certain circumstances.

"I think the assumption that all NZ foreign trusts are being used for illegitimate purposes is unfounded and based largely on ignorance," he said in reply to written questions.

Read Roger Thompson's full replies to our questions here

An Auckland University tax law professor Michael Littlewood has previously been in little doubt New Zealand is being used a tax haven.

"A workable definition ... is that a tax haven is any country that wilfully allows itself to be used as a means of avoiding other countries' taxes. By this definition, New Zealand is plainly a tax haven," he said in a study last month.

The government's response to the revelations to date has been to appoint a tax expert, former PwC chairman John Shewan to conduct an inquiry and make recommendations on the rules and disclosure conditions for the trusts and companies concerned in the industry.

Mr Shewan's appointment was put under the spotlight for a period, but he's since been left to get on with the job.

Prime Minister John Key said Inland Revenue would follow up any revelations from the Panama Papers involving New Zealand, but was rejecting calls for the industry to be shut down.

"It would be, I think be a dangerous decision to make as a knee-jerk reaction just to ban a foreign trust overnight, because we have very good tax rules, they're integrated rules and they're respected around the world."

He said New Zealand was working with other OECD countries to shut down tax loopholes, the next step in that co-operation comes this week with London Anti-Corruption Summit being hosted by British Prime Minister David Cameron, which Police Minister Judith Collins will attend.

*The investigation into New Zealand links in the Panama Papers is a journalistic collaboration by reporters from RNZ News, One News and investigative journalist Nicky Hager, and with the assistance of the International Consortium of Investigative Journalists and the German newspaper Süddeutsche Zeitung.