The Panama Papers story is a hard one to tell, but underneath the tales of Brazilian online gambling tycoons, world leaders and Venezuelan bankers are important issues that need to be addressed.

The prime minister argues there are legitimate reasons to have a foreign trust, for example to protect one's assets in an unstable country. Photo: RNZ / Toby Morris

One of the questions repeatedly asked is why should New Zealanders care about this story, prompted by a massive leak of documents from the Panamanian law firm Mossack Fonseca.

Journalists working with the International Consortium of Investigative Journalists (ICIJ) and the German newspaper Süddeutsche Zeitung published the results of their year long investigation at the start of April, which set off a chain of events around the world.

New Zealand warranted some mention, but the real focus on this country has only been since a team of journalists from RNZ and TVNZ, and the investigative journalist Nicky Hager, was given access to the Papers about a fortnight ago.

We had access to the same documents in the initial release, but were able to delve into the material that related specifically to New Zealand, and build a picture around that.

Digging into the Panama Papers - (L-R) Patrick O'Meara, Lee Taylor, Jessica Mutch, Gyles Beckford, Jane Patterson, Andrea Vance and Nicky Hager. Photo: RNZ / Jeremy Brick

And what we found was a significant and increasing amount of activity conducted by way of New Zealand trusts and companies, co-ordinated through an office set up by Mossack Fonseca in central Auckland.

The number of foreign trusts established in New Zealand has steadily risen over the past decade, with a noticeable pick up since 2012.

Alongside that, New Zealand is actively promoted to potential clients in South America, and by Mossack Fonseca as a desirable jurisdiction because it has such a favourable business and tax structure for the services it offers to its international clients.

So what?

What struck me the most, as I went through the screeds of documents, was the deliberately complex structures designed to disguise the names of those who owned the assets or the money, or at least not have them readily accessible.

Many of the trusts and companies had New Zealand lawyers and accountants listed as directors, and the addresses of those law firms as the registered address of those entities.

What that means is the one page document the Inland Revenue (IRD) receives as a record of the trust tells it nothing about who is behind those trusts.

If there is nothing to hide, why go to such great lengths?

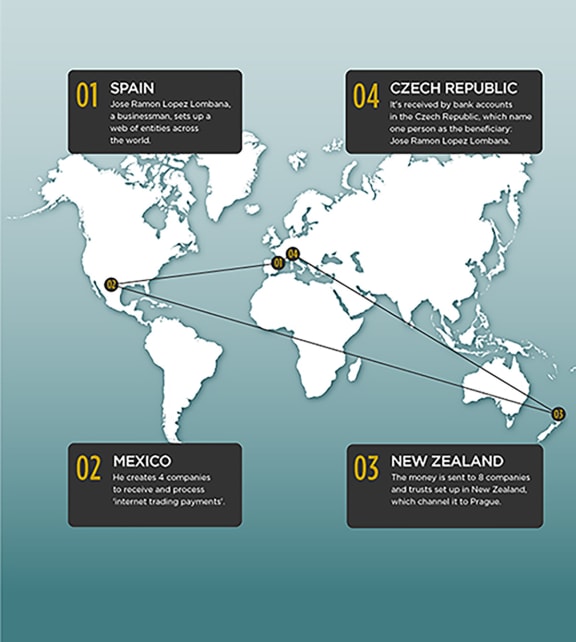

The other result of this is if, for example, Mexican tax authorities have suspicions about one of its citizens hiding money overseas, it cannot readily search for their name in other jurisdictions, and it cannot come to New Zealand on a fishing expedition without the specific details.

So all of the talk about New Zealand having a full disclosure regime, one of the government's main defences of the foreign trust regime, is disingenuous.

There is, in principle, the ability to share information, but not if tax authorities do not know what to look for.

Graphic: RNZ / James Sanday

Another question posed is whether foreign trusts are disguising illegal behaviour.

We cannot say and that is the point.

The structure is designed in such a way that it is very difficult to ascertain whether the activities buried deep within these trusts and companies are lawful or not.

The prime minister argues there are legitimate reasons to have a foreign trust, for example to protect one's assets in an unstable country, or in the case of Mexico with its unpredictable inheritance laws, to ensure family wealth stays within the family.

I asked John Key, however, why would a Brazilian businessman, with no other links to New Zealand, need to set up a foreign trust in New Zealand in relation to his business dealings?

A question he was unable to answer.

And that is the question for New Zealanders - do we want this country to be used by people whose motives and source of income are not always clear, to at - the least - minimise their tax obligations?

Is this a double standard when the flip side of New Zealand's tax system rigorously requires citizens to meet their tax obligations?

In terms of the government's response it has been a two-pronged strategy - defend the general legitimacy of New Zealand's regime, but remain open to changes if problems are identified.

A strategy the prime minister is deft enough to deploy successfully, although derailed somewhat by the inclusion in the debate of the Red Cross, Greenpeace and Amnesty - by his own hand.

During a rowdy and charged debate in the House this week, Mr Key gleefully reeled off the names of the three organisations saying they all appeared in the database.

All three charities were unimpressed, pointing Mr Key to media reports in 2013 about how their names had been used as a scam to raise money, and insisting they had no links to Mossack Fonseca.

Fluttering his eyelashes innocently, Mr Key explained he just wanted to point out the data was not always what it seemed, and to be aware of how it was used.

Certainly not the point he was making when lambasting the Greens co-leader James Shaw in Parliament about attacking financiers but being offended when his "mates" were implicated.

That tirade led to the prime minister being ejected from the House after he ignored the Speaker's entreaties to sit down.

John Key was kicked out of Parliament for disobeying the Speaker Photo: YouTube

Not that Mr Key seemed too concerned about skipping out of question time early, and avoiding another question about the Panama Papers.

The government has ended the week relatively unscathed as a result of the Panama Papers but the story was never intended to target the government and specific ministers, but rather to highlight how the system operates and the effect that potentially has on New Zealand's reputation.

In the end it is up to New Zealanders to decide how much they care, and whether they want to see this kind of activity continue in their country.

*The investigation into New Zealand links in the Panama Papers is a journalistic collaboration by reporters from RNZ News, One News and investigative journalist Nicky Hager, and with the assistance of the International Consortium of Investigative Journalists and the German newspaper Süddeutsche Zeitung.