Tax reductions for middle income earners may be on the cards, Finance Minister Bill English says, but he warns there will be many demands on the predicted budget surplus.

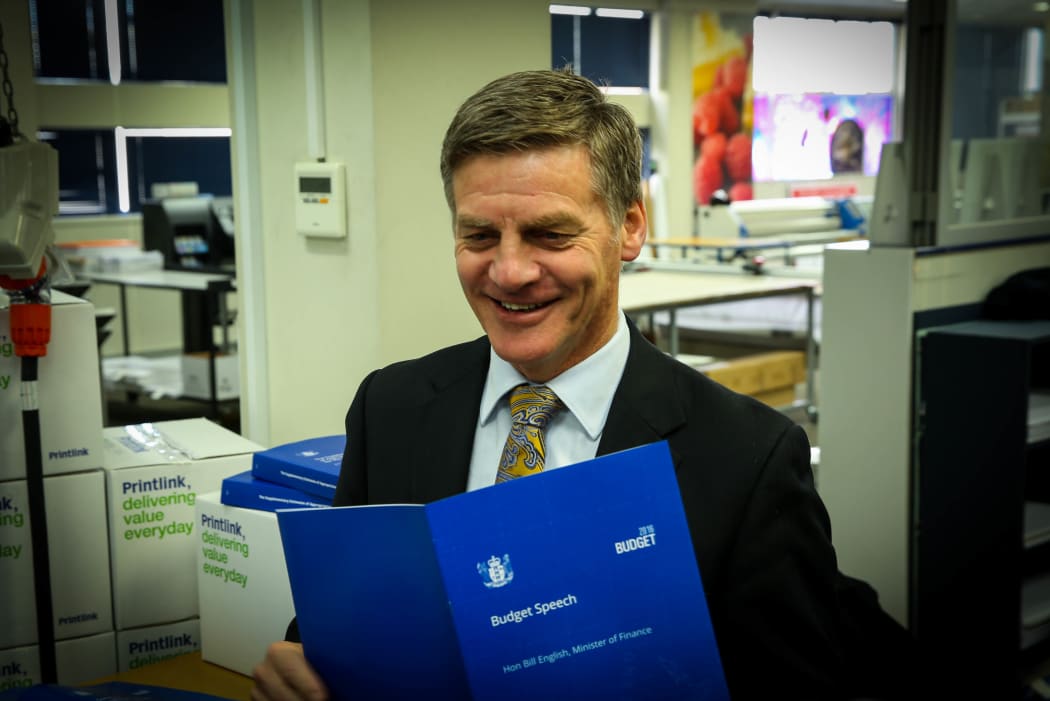

Photo: RNZ/Elliott Childs

Mr English delivered a careful Budget yesterday.

He said a stronger economy was helping boost the government's coffers, with rising surpluses predicted over the next five years.

The economy was predicted to grow at an average 2.8 percent over the next five years and unemployment to fall gradually to 4.6 percent by 2020.

Mr English told Morning Report he would like to use that extra cash to provide tax cuts, but warned there were demands on the money.

"It looks like we'll have rising surpluses - how far they'll rise will depend on circumstances.

"There's still going to be quite a lot of pressure on a lot of those surpluses; money to go into the Super Fund, start saving for the future again, paying off debt.

"We would like to see some tax reductions, particularly for those middle income taxpayers who find themselves getting into higher tax brackets.

"And of course there's ongoing demand for more public services as the population grows."

Labour Party's finance spokesperson Grant Robertson told Morning Report the surplus forecast was based on "some pretty big assumptions" such as dairy prices increasing and immigration falling.

He said there was not enough money in the budget for tax cuts in the 2017/2018 year.

"I think New Zealanders are looking at this and saying 'we've got enormous need in housing, in health, in education'. We need to start growing our regions to create jobs there, we need to contribute to the Super Fund.

"They are bigger priorities than National storing money away for a tax cut election bribe."

Labour still believes sizeable tax cuts would not be affordable, but the party is more open to reviewing income tax thresholds.

Leader Andrew Little said there would be much greater demands on any spare money for health, education and superannuation fund contributions than for tax cuts, but thresholds could be reconsidered.

"There is a case to say yes, of course you should review those thresholds, but when you've got a boast from the Prime Minister now - it's kind of $3 billion of tax cuts - well that's the stuff I think a lot of people will find disturbing given the social deficits that we've got."

Mr Little said Budget projections show real wages will actually fall in 2017 and 2018, and the government should focus on pushing up incomes.

Auckland housing

The Budget earmarked $100 million to free up Crown land for Auckland housing and another $200m for social housing places in the region.

Eventually "a couple of thousand" houses would be built on surplus Crown land bought to boost the housing supply in Auckland, Mr English said.

On social housing, instead of waiting for more houses to be built, the government will get houses from providers.

"We have more money than we can procure houses," he said.

The $200m set aside in the budget would provide 750 social housing places as soon as the houses can be found.

Mr English said more than 500 social housing units were being built in Auckland this year, and up to 1000 a year would be built over the next few years.

"But we don't wait round for that. We have enough money now to procure 750 places but because there's a lot of competition for the houses in Auckland the government is out there competing with everyone else for the houses.

"We'll build as many as we can but it's subject to the same constraints as everyone else."

Mr English said the Budget was about the long term.