Spark faces political and anti-competition hurdles ahead of getting its recently announced 5G network - which isn't really for phones anyway - tech journo Bill Bennett says.

Social media Photo: 123RF

Bennett is a freelance journalist who has written for NZ Business and the NZ Herald, and runs an independent technology blog.

He also tells Nine to Noon's Kathryn Ryan phone brands are likely set for a bloodbath, and the Trade Me offer probably isn’t good news for regular Kiwis.

5G is not for phones

Bennett explains that while the earlier networks - 1G to 4G - were largely for mobile phones, the advantages of the 5G network is much broader than that.

"There are few phones - in fact I don't think there's any at the moment on sale in New Zealand - which are actually 5G ready," he says.

"It's not such a big deal because 5G isn't about mobile phones ... it's more about a wireless communications infrastructure."

He says with 5G the mobile internet speeds will be faster - but at a certain point that doesn't make a difference.

"Mobile phone speeds are not actually noticeably slow, you only need a couple of megabits per second to download high quality, high definition video … having it run 10 times as fast, 20 times as fast isn't that big of a deal to a phone user."

He says the real advantage 5G would bring is something called network slicing.

"It means that a company like Spark can divide up its 5G network and sell off private bits of it to other organisations. So, for example, you could have a private network on the 5G network for, say a freight company.

"Its trucks can talk to base and talk to each other and so on - and will never meet congestion because they've got spectrum set aside for their use."

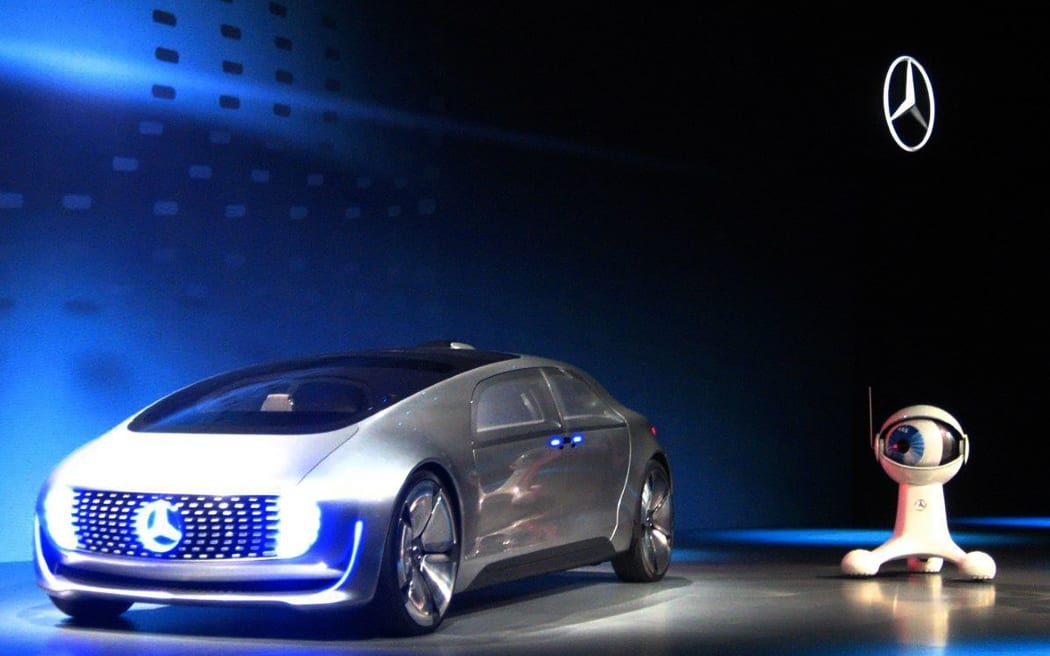

He says that ability is particularly essential for something like autonomous vehicles.

The Mercedes Benz F 015, an electric and autonomous concept car, unveiled in 2015. Photo: AFP

"They're not that autonomous, they have to report back," he says.

"You don't want a car that's travelling at 100km/h to have to compete with people chatting to each other on Facebook to get some spectrum to get it to turn its brakes on in a hurry."

Spark's 5G network bid

Bennett says Spark's announcement - that it's going to supply a 5G network by the time of the 2021 America's Cup - is perhaps jumping the gun a bit.

"We don't even know yet when the spectrum will be ready - the spectrum [auction] dates haven't been announced yet."

That auction - when the government sells of rights of access to a particular bandwidth - is expected to come before long, but what form it will take is a different question.

"It's not all in Spark's court - getting that spectrum organised is really down to MBIE, and to a lesser degree to Parliament.

"I think at this stage they haven't even decided if they're going to use it as a scheme for raising money or a scheme which is the optimum allocation of the available spectrum."

As an example, the 4G spectrum was allocated equally between Spark, Vodafone and 2degrees with three 'blocks' for about $25 million each, he says, but 2degrees couldn't afford to pay for its third block.

"So the final block of spectrum was auctioned, and Spark paid - I think it was $185m - which tells you what the real commercial value of that spectrum is to a telecommunications company."

Photo: RNZ / Kim Baker Wilson

It's a problem of avoiding a monopoly because Spark, he says, has a lot more money to play with.

"When Spark demerged from Chorus, Chorus ended up with a lot of Spark's debt, so Spark is a relatively debt free for a company of its size … it's also got reasonably good cashflow."

That's also a problem for Vodafone and 2degrees because if the allocated spectrum goes unused for too long it reverts back to the government, and they don't have networks ready to go either.

"In other words that you've got to build a network pretty fast after you've bought the spectrum so the cost of doing both would run to hundreds of millions of dollars."

Five Eyes and political complications

The other problem is political and, he says, very controversial: New Zealand's international Five Eyes partners in communications security are putting pressure on the government to avoid networks built by Chinese provider Huawei.

"The US has banned them, Australia's banned them from networks, the UK has allowed them but with very heavy restrictions, and there's pressure on our government not to allow Huawei to build these networks.

Leaders from four of the Five Eyes nations - Australia's Malcolm Turnbull, Britain's Theresa May, Canada's Justin Trudeau and New Zealand's Jacinda Ardern - meet in London in April. Photo: Pool

"Huawei has been Spark's innovation partner in that space for quite some time now."

However, that puts the government between a rock and a hard place because Huawei's only real competition internationally is Nokia. Ericson and Samsung have a little bit in that field, but would not be ready for the New Zealand market.

"If Huawei's not in the picture and there's only really one supplier who's up and ready to go in New Zealand tomorrow, their price is going to be higher."

Phone brand bloodbath

Meanwhile, Bennett says it looks there's a global decline in mobile phone sales on the horizon.

"There was huge spurts of growth because what was happening was people were buying their first smartphone."

That trend moved from the first world to the developing world, he says, which led to long-term double-digit growth.

"That's come to a halt now. Pretty much everyone in the world that wants a smartphone has got one - or if they haven't got one it's because they can't afford it, unfortunately.

woman sitting on window sill with smart phone Photo: 123RF

"Phone makers, instead of selling more phones they've been slowly putting the price of their phones up to keep their revenues up … but now what's happening is the market is possibly tanking."

He says phone sales could drop in this quarter, with components suppliers already reporting reduced orders.

All this means the number of phone makers is likely to drop dramatically, he says.

"There's actually about 600 mobile phone brands worldwide and that's just way too many.

"Look at this from the other direction - Apple makes about two thirds of all profits from selling mobile phones; Samsung and Huawei make about a quarter of the profits.

"The rest is shared between, pretty much, 600 companies.

"Well, they're not all going to survive. There's going to be a bloodbath and there's going to be a huge shake out and we're going to very quickly see a lot less brands on sale."

Good for Trade Me, bad for Kiwis?

Bennett says British investment company Apax's recent bid to buy online auction site Trade Me seems likely to go ahead.

"They're offering around $2.5b for Trade Me, and if you remember back to 2006 Fairfax bought it for $700m so we're talking about roughly two to three times what it was worth then.

"Trade Me is kind of assumed to have maxed out, it doesn't have much more room for growth in the New Zealand market with the way things are at the moment."

Trade Me website Photo: RNZ

It makes sense then that Trade Me's shareholders and board would go for the sale, he says. The question is why Apax would make such a strong offer for a company with limited growth.

The answer to that could lie in Apax's other international assets.

"The Apax group owns Trade Me-like companies in other countries," Bennett says.

"If it can see a way out of things for that Israeli version of the company then probably it can see a way out for the New Zealand business that people here can't see at the moment."

One such option for them would be global consolidation - Frankensteining the companies - or their technologies - together.

"So it's possible that some of the technology that's available at Trade Me is useful to the other investments."

Another possibility is that Apax sees some value in the margins Trade Me has.

"My guess is the people that are buying it have something in mind, something specific in mind."

He also thinks the deal won't be good news for consumers, especially considering how comparatively expensive it is to us Trade Me's biggest global competitor - eBay.

"My gut feeling is that one of the things it will do is put prices up.

"You get charged whether you sell or not on eBay whereas Trade Me lets you carry on selling again and again and again until you actually find a buyer.

Meanwhile, the critical mass advantage that Trade Me has in New Zealand - that it's useful because that's where everyone is - can unravel really fast with a number of other competitors waiting to jump in, Bennett says.

"I recently bought something from Alibaba - it was a tool to fix my computer and I saw the same thing on Trade Me for about 20 bucks and it was another $7 for postage - I bought this tool on Alibaba for 89 cents including postage.

"Trade Me simply can't compete with that."