What started as a dinner party meeting two years ago would mark the beginning of a co-housing project that’s almost at the construction stage. But the cost of building and the difficulty some regulators have in understanding the project is leaving it hanging in the balance.

It was something Tania Sawicki Mead and her friend Nicole McCrossin had been talking about for a while. It was time to sit down and gauge the interest, and whether there would be enough people in their wider social circle who may share their vision.

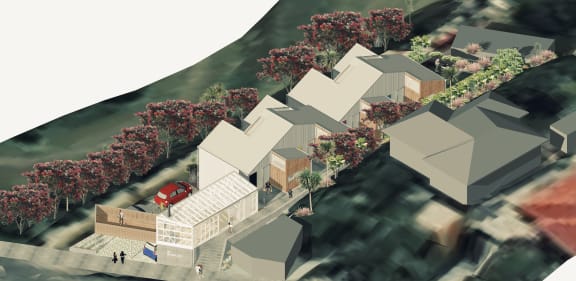

Design by Space Craft Architects

“We started with a few dinner parties where we invited an architect, a property lawyer, various professionals and really went through the process of figuring out what the existing models internationally and in New Zealand were and where we might fit into that.”

They ended up with co-housing and a multi-unit model.

Two years down the track and together with four of their friends – making it two couples and two singles - they've purchased a property and some are living together in the house on the site, planing their dream project.

“The house that we’re living on ... is really compact and I think we’re becoming really open to the idea that a well-designed small space is better than a large, cold, poorly designed one. Where we’ve got to with the size and shape of it, we’re really happy,” Sawicki-Mead says.

The group are planning to move the house off the site, says fellow member of The Buckley Project Joe McCarter, and build four terraced townhouses.

“[The property's] 650 sq metres, they’ll be fairly small units, about 77 sq metres, as well as communal spaces on the eastern and western ends of the site.

"The idea is that we all have our own units, our own unit title, and our own sellable house but that there are some areas in common that we can come together.”

They’re keen to start work on the construction next month, however, the dramatic increase in the cost of building, and the difficulty some people in finance and regulations have in understanding the project, means their plans are hanging in the balance.

“There’s no real framework in New Zealand, there’s no single place that you can go to and say please help us work through what are our obligations hereunder the law and how we might, for example, purchase property as a collective and then transfer it to individuals.

"Not to say that there aren’t those pathways, because we’ve found them, but there’s no clear visible process.

"For example, on the tax front, we had advice from someone who we trust, which is great, but we still understand we’ll be existing in somewhat of a grey zone when it comes to the transfer. When you get KiwiSaver involved and when you’re actually doing something for the first time all of this stuff is based on precedent and there’s just not sufficient precedent,” Sawicki-Mead says.

The common building of the Buckley Road co-housing project. Photo: Supplied / Space Craft Architects

When purchasing their property, the group had to develop a 60-page deed themselves and cross their fingers that once that had put an offer in, they'd be able to use their KiwiSaver accounts.

Luckily for them, they did.

“Buying the house together, the first purchase of the actual land and house, we expected to be relatively difficult, but it wasn’t.

“Once we come to try and develop the property we’ve run into issues because having four houses on a site means you’re categorised as a developer,” McCarter says.

They have resource consent for the project and are working towards building consent. But being categorised as developers, rather than people building their first home, has been a stumbling block.

Front view of the Buckley Road co-housing project. Photo: Supplied / Space Craft Architects

It means higher costs – about an additional $100,000 over the course of the project.

Originally, they were aiming for each share, including common areas, to total a cost of $600,000-$650,000. But that number is now looking more like $750,000.

Under the law, they’re working in the parameters of a Unit Title.

Unit Title owners own a defined part of a building, like the group’s individual units, and share ownership of common areas, like driveways and elevators. All unit owners become part of the body corporate.

Related stories:

Sawicki-Mead says if they were to design their own legal structure, it wouldn’t look drastically different but would understand that the common areas are a crucial component of the value of the house and the way the houses function on the site.

“It’s created complications for how we share… small little things like how we use the small spaces in front of our property and whether they have to be designated, like for fire reasons, no one from the unit next to us is allowed to walk into the bottom floor of our property. If Joe calls a fire engine, they can’t come into my unit without my consent because that essentially violates the rules of the unit title.”

Essentially, regulations like this don’t understand the interrelationship of shared ownership.

And if someone decides it’s time for them to move?

As they will communally own the common areas under a body corp structure, if someone wants to sell, they would sell their individual unit, plus a portion of the body corp.

“The idea being, if you have those common areas, you can have a much smaller, more compact space because you need an area to live in and you need a space for expansion or coming together outside of that,” McCarter says.

They never were wanting to be a prototype for this kind of project, says Sawicki-Mead, but wanted to indicate to others that it’s a possible model.

They’re also keen to address the fact that there is insufficient land in Wellington, that house prices are too high and that so many houses are poorly designed – they’re too big and they’re cold.

“At the moment we’re seeing kind of a stalemate on the housing front, if you look at the challenges that KiwiBuild has faced and you look at the challenges of the building market because costs have escalated so drastically, what we need is some innovative solutions that will help us provide a way for other people to get involved in housing - developing well designed, warm, central housing.

“This is an obvious solution but there are those mechanisms missing,” she says.

“What is the risk of the status quo? The risk of the status quo is that no one gets anything of medium density built in a city like Wellington.”