A currency expert is predicting the falling New Zealand dollar could slump to its lowest point against the US greenback since the global financial crisis.

It eases the pressure on manufacturers and debt-ridden farmers, but spells bad news for the cost of living.

The dollar fell two percent and today has remained steady at just over 70 cents following the Reserve Bank's cut to the Official Cash Rate.

With further cuts predicted by the Reserve Bank, the dollar is tipped to fall even further.

Reserve Bank of New Zealand Photo: RNZ / Alexander Robertson

But Westpac's currency strategist Imre Speizer said a strengthening US dollar was the key driver.

"The longer running theme has been one where the US dollar has strengthened as the US economy has recovered and as the central bank there is preparing to raise interest rates," he said.

He said the exchange rate could fall to its lowest point since mid-2009.

"I think it could fall as far as 65 cents, but if you look at New Zealand on aggregate, we are an export nation, and we tend to benefit more when the exchange rate falls."

That would spell great news for exporters and farmers - who have battled against an overvalued dollar which a year ago was as high as 88 cents on the greenback.

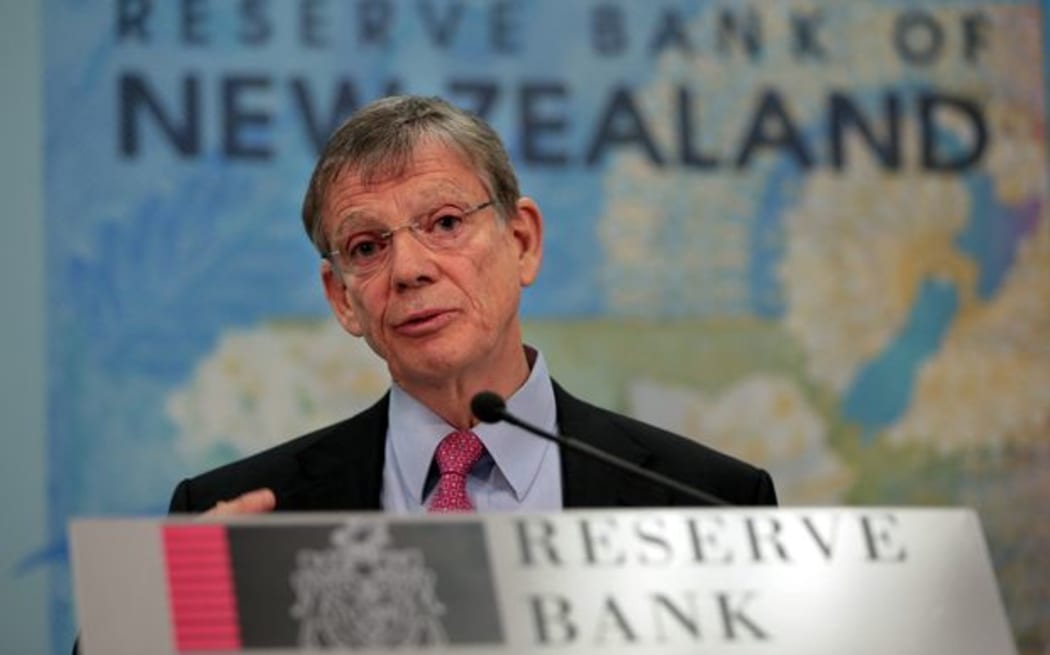

Reserve Bank Governor Graeme Wheeler Photo: RNZ / Diego Opatowski

Reserve Bank's Governor Graeme Wheeler said reduced interest rates on lending could help hard-pressed farmers.

Their total debt now stands at about $30 billion, 25 percent of whom have negative cash flow right now.

King Salmon's chief executive Grant Rosewarne said his company was reaping the benefits of pushing into the US market and taking advantage of favourable export prices.

"We're delighted that we've maintained our business into the US because it is so profitable for us," he said.

"To have the US market in such a favourable position is extremely helpful."

The head of the Manufacturers and Exporters Association, Dieter Adam, said one of the biggest problems has been attracting skilled workers, but the falling dollar would help.

King Salmon's chief executive Grant Rosewarne. Photo: Supplied

"That's one of their major concerns - and it goes right from software engineers to skilled machine operators," he said.

"Some of the machinery our members now use require operators that need two year's training before they're competent."

But on the other side of the coin, the price of imported goods was expected to go up.

4 Guys Autobarn in Hamilton imports cars from the US, and its sales manager Grant Chapman said the difference in the exchange rate over the past year meant they would pay $8000 more for each car.

"We monitor it every 20 minutes because it's a key thing for us to buy when the dollar is at its highest," he said.

The AA's Mark Stockdale said the cost of petrol - the country's biggest import - would also rise as the exchange rate fell.

"The fuel companies pass on any of those changes within a couple of days at the most - so we see changes at the pump very quickly," he said,

The Importers Institute said it was optimistic the dollar wouldn't tumble any further, despite experts picking the opposite.