The long-awaited South Canterbury Finance trial almost didn't happen after defence lawyers asked for it to be stopped over a perception of bias on the part of the trial judge.

The Crown on Wednesday opened the country's biggest-ever fraud trial in the High Court at Timaru against the former chief executive, Lachie McLeod, and former directors Edward Sullivan and Robert White.

The charges, brought by the Serious Fraud Office (SFO) , include theft by a person in a special relationship, false statements by a promoter, obtaining by deception and false accounting. All up the men face 18 fraud charges relating to the $1.6 billion collapse of SCF in 2010.

But the judge hearing the case rejected defence arguments there could be a perception he was biased towards the Crown case.

Lawyers for the three accused had argued there was a perception of bias on the part of Justice Heath because of comments made by SFO director Julie Read at a conference last week.

They said Ms Read's remarks that the office was fortunate to have Justice Heath as its trial judge could lead to a perception he was biased towards the office.

The lawyers asked that Justice Heath consider stepping down to avoid a perception of bias but he rejected that.

"Whatever her reason may have been for expressing that view, I do not currently see, on the evidence, any link between it and whether I will perform my judicial function impartially."

Five charges have been laid against Mr McLeod, a farmer and the company's chief executive from 2003-2009. Mr Sullivan, a director of the company for 20 years and former partner of a Timaru law firm, faces nine charges, while Mr White, who was a director for 16 years, is on four charges.

South Canterbury Finance

For most of its long history, the Timaru-based SCF was a mid-level company with a relatively modest book when it came to deposits and lending.

Chairman Allan Hubbard was famous for his eschewing of the high life; he lived in a modest Timaru home and drove an old Volkswagen Beetle.

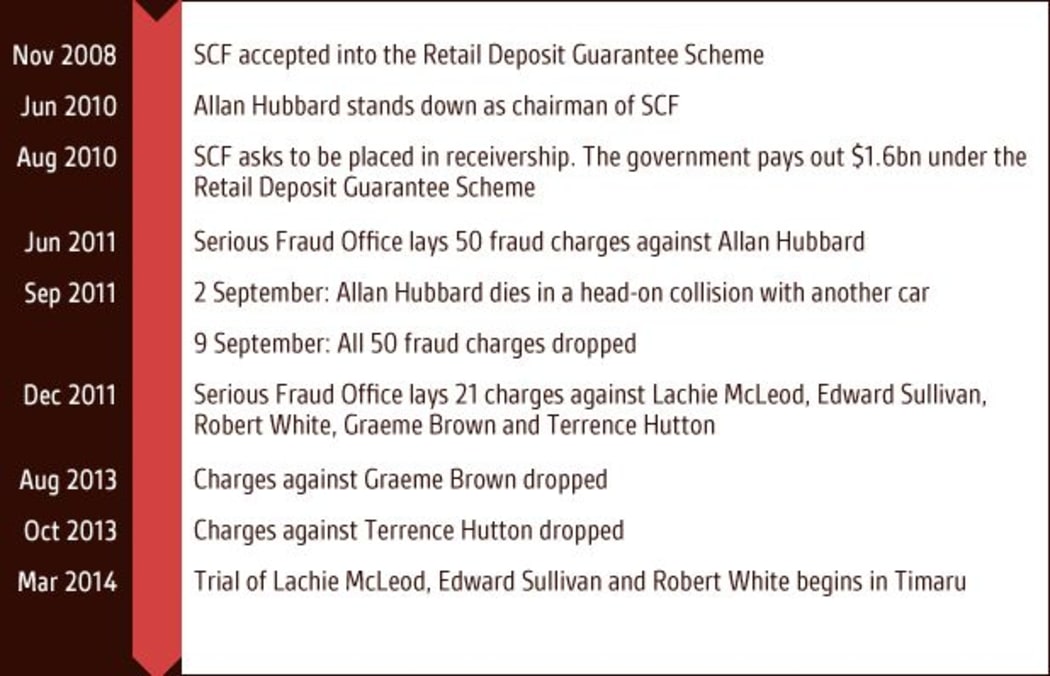

But when the global financial crisis hit in 2008, the then Labour Government introduced the Retail Deposit Guarantee Scheme, principally to shore up the big banks. However, it extended to SCF in November of that year because it was seen as a stable proposition.

Four months later, the finance company's deposit base had increased by 25 percent, as depositors chased the higher interest rates being offered by the company, safe in the knowledge their money would be returned by the Government if the company went under.

Seven months in, deposits had grown to $800 million and the company's risk profile had grown through a series of loans to property developers.

By the time it asked to be placed in receivership in August 2010, it owed depositors $1.7 billion.

The Government subsequently paid out $1.6 billion to 35,000 investors as part of the guarantee scheme.

Allan Hubbard

Mr Hubbard died in a car crash near Oamaru in September 2011 aged 83 - three months before any charges were laid over South Canterbury Finance.

He was the company's chairman at the time of the alleged offending and at the time of his death was already facing 50 fraud charges relating to two of his companies, Aorangi Securities and Hubbard Management Funds.

It is not known if Mr Hubbard was ever investigated over the alleged fraud involving SCF, and a spokesperson for the Serious Fraud Office says it doesn't comment on investigations.

Graphic: RNZ