Former South Canterbury Finance chairman Allan Hubbard was against entering the Crown's Retail Deposit Guarantee Scheme because it would reduce his influence over the company, a court has been told.

Former chief executive Lachie McLeod and former directors Edward Sullivan and Robert White are facing 18 fraud charges relating to the $1.7 billion collapse of the company in 2010.

South Canterbury Finance had been accepted into the Crown Retail Deposit Guarantee Scheme during the 2008 global financial crisis. The Government ended up paying $1.6 billion to its depositors in 2010.

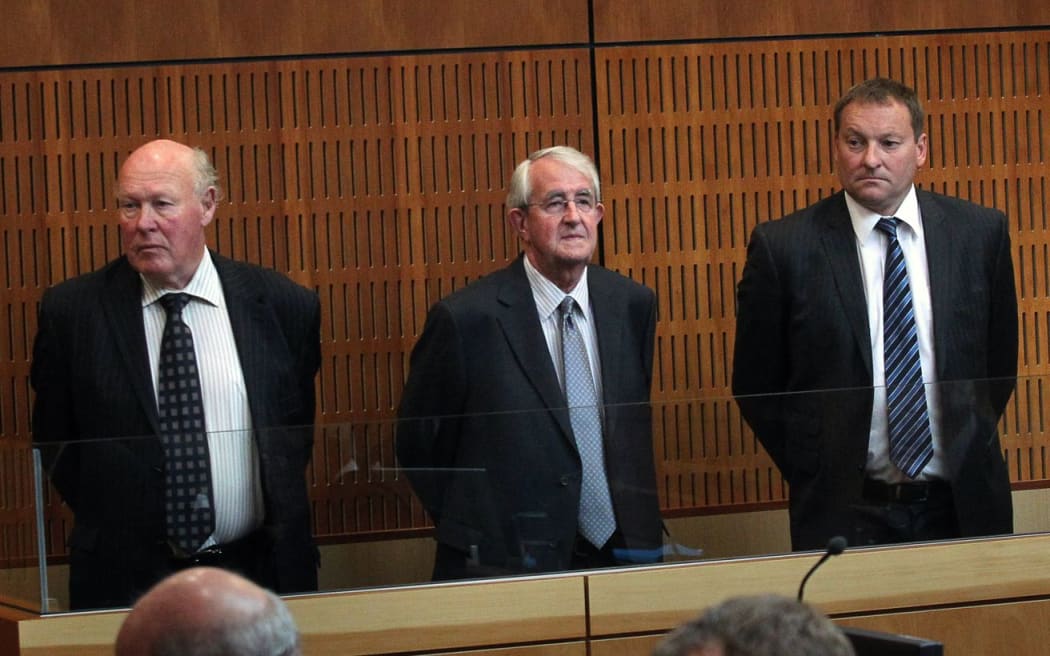

From left: Edward Sullivan, Robert White and Lachie McLeod. Photo: Mytchall Bransgrove

On Tuesday, former chief financial officer Graeme Brown appeared at the High Court in Timaru as a witness for the defence after a charge of false accounting against him was withdrawn.

Mr Brown said Allan Hubbard wanted to stay outside the scheme, because of the extra level of oversight that came with it and this would have limited Mr Hubbard's ability to carry out lending to customers without board approval.

"The ability to limit Mr Hubbard's influence is important, because from time to time Mr Hubbard would undertake transactions or undertake lending to clients that wasn't within the normal internal controls of the business."

He said entering the scheme was seen as a way to modernise the company.

Mr Brown told the court that he gave a true account of South Canterbury Finance's books, despite one director saying that they had been 'cooked'.

He rejected claims in an email from Robert White that they had been telling investors less than the truth for some time and said he had no doubt that his reporting of the accounts was accurate.

Mr Brown was asked to explain a memo where he said 'we continue to defy gravity and report great results by fudging the truth.'

He said this was because Allan Hubbard would buy back any bad loans himself, effectively keeping them off the company's books. He described Mr Hubbard's approach to business as antiquated.

Mr Brown said having a charge of fraud laid against him has had a profound impact on his life. Holding back tears, he said the charge led to the break-up of his marriage and a change in career.

After the charge was withdrawn, the Serious Fraud Office interviewed Mr Brown with the intention of calling him as a witness - something he said he was happy to do.

Allan Hubbard died following a car crash near Oamaru in 2011.