A defence witness in the South Canterbury Finance trial says the former chair of the company, the late Allan Hubbard, preferred related-party loans as he felt they were a more reliable form of lend.

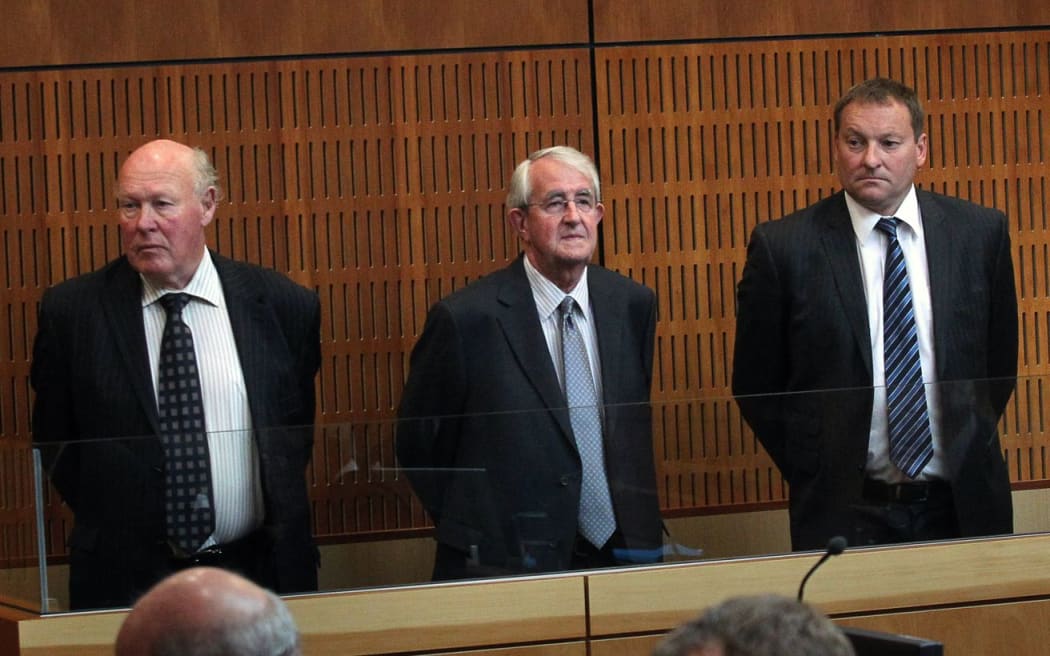

Three of the company's former directors, Lachie McLeod, Edward Sullivan and Bob White, face 18 fraud-related charges related to the company's collapse in 2010.

A former accountant for the company, Terry Hutton, told the High Court in Timaru on Thursday that Mr Hubbard considered related-party loans stronger than loans to a third party of whom he had less knowledge.

Mr Hutton agreed with Justice Heath that it was very much a case of "Trust me, I know what I'm doing".

Mr Hutton said that where possible, Allan Hubbard would take shortcuts. He said he doesn't think it was for any sinister purpose, but for ease of administration.

Mr Hutton gave the example of Mr Hubbard acquiring a subsidiary from South Canterbury Finance, when it was in fact owned by another subsidiary, thereby short-circuiting the process.

From left: Edward Sullivan, Robert White and Lachie McLeod. Photo: Mytchall Bransgrove