The South Canterbury Finance trial has been told a loan to the chairperson of a related company was not a loan to the company itself.

The defence is continuing its closing submissions at the High Court in Timaru.

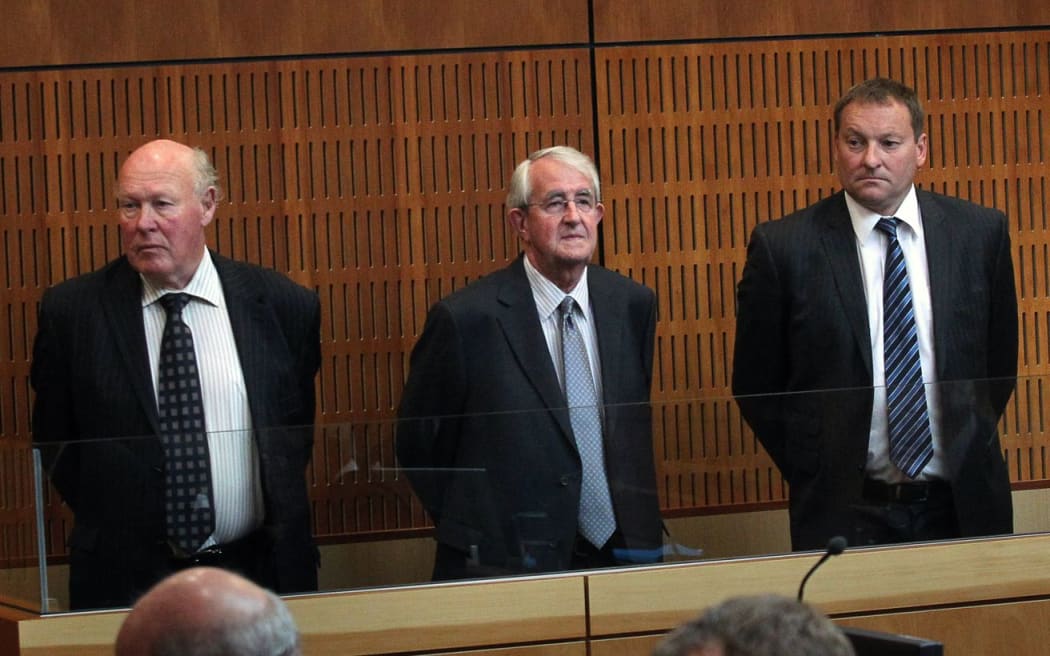

Two of South Canterbury Finance's former directors, Bob White and Edward Sullivan, and former chief executive Lachie McLeod face 18 fraud related charges for the company's 1.7 billion collapse in 2010.

South Canterbury Finance was obliged under its trust deed to disclose related party loans above 35% of shareholders funds.

Defence lawyer Pip Hall told the court today that South Canterbury's ownership of a third of Dairy Holdings meant it was a related party, but a $12 million loan to the company's chairperson Collin Armer wasn't a related party loan.

Mr Hall says in the event of his company being in receivership, it would be Mr Armer who had to pay the loan back, not Dairy Holdings.

Witnesses including forensic accountant John Hagen agree that the loan wasn't a related party one.

Mr Hall says the Crown has largely ignored the evidence of Mr Hagen regarding a disputed loan to the company Woolpak, saying it was not a related party to South Canterbury Finance and did not require disclosure.

Mr Hagen told the court that a loan to Woolpak was in South Canterbury Finance's ordinary course of business.

From left: Edward Sullivan, Robert White and Lachie McLeod. Photo: Mytchall Bransgrove