Revenue Minister Todd McClay says fugitive killer Phillip John Smith was most unlikely to have used the nearly $50,000 he stole from taxpayers to fund his escape.

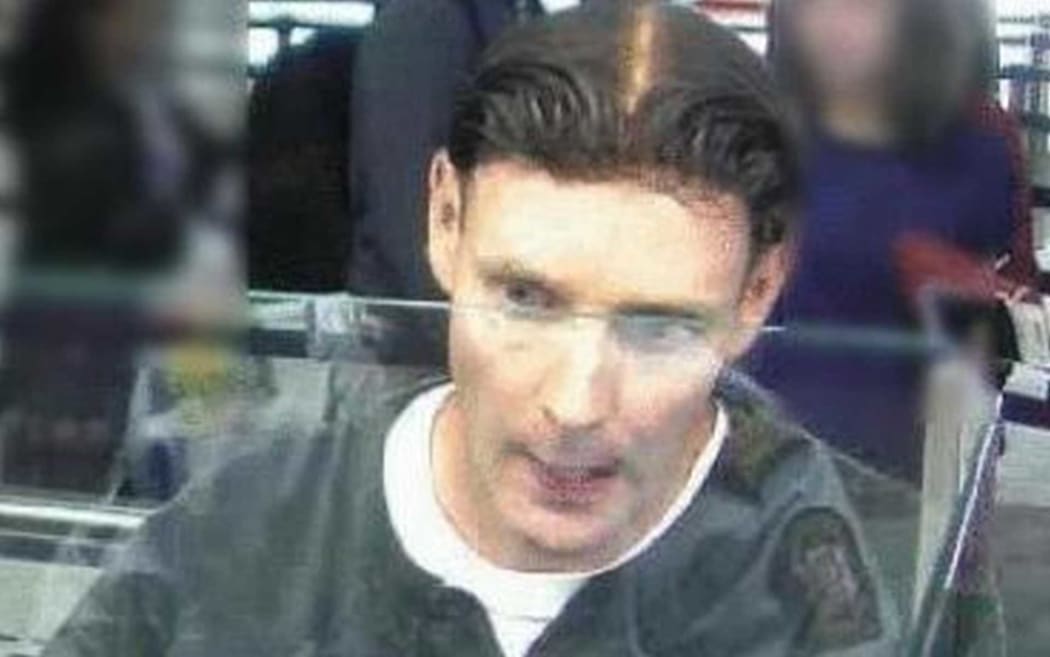

CCTV footage of Phillip Smith as he passed through Auckland Airport. Photo: NZ Police

Smith, who is in custody in Rio de Janeiro after fleeing New Zealand while on temporary release from prison, was convicted in July 2012 on 12 charges of obtaining tax credits by deception, totalling $47,565.

In a written statement, Inland Revenue said Smith was sentenced to 15 months imprisonment and reparation of $50 per week.

"Inland Revenue undertook a large volume of bank tracing in order to identify where the refunds went but the funds were not able to be recovered."

However, Revenue Minister Todd McClay said the case showed Inland Revenue's sophisticated tools and system to detect fraud have worked.

"I've sought assurances from the Commissioner that everything possible was done both through the prosecution and to reclaim the money, and I've received those assurances.

"The important thing is a fraud was identified, a prosecution was sought and found, and Inland Revenue has looked at it to see what else should be done in this area."

Mr McClay said it was "highly unlikely" that Smith could have used his ill-gotten gains to fund his escape, but confirmed the question of where he got his money from was likely to form part of a wider multi-agency investigation.

Smith was apparently claiming tax refunds and Working for Families tax credits under the names of other people, including prisoners

When he fled New Zealand last week he declared $10,000 cash at customs.

Executive director of the Taxpayers' Union Jordan Williams said the case showed Government departments were still not sharing information.

"It does suggest serious vulnerabilities that someone sitting in a prison can rip off taxpayers by nearly $50,000."

Labour Party revenue spokesperson, David Clark, said it was "lax oversight by the Government" that had allowed a criminal in prison to rort taxpayers.

Dr Clark said furthermore, there were no guarantees that other prisoners were not exploiting other loopholes.

He said the Minister needed to give the public an assurance the loopholes have been closed and their own details are being kept safe.

"I don't think we will see this money again, it is a result of lax oversight and clearly failures on behalf of the Government.

"We failed to stop him, as a country, leaving, we discovered he's been running businesses illegally behind bars, now on top of that he's rorted the tax system."