Twenty-five dollars may seem like a little or a lot depending on who you ask.

See photos

The Government's Budget this week provided for increased payments for beneficiary families of $25 per week after tax, starting next April.

It is the first time core welfare rates have been increased since 1972.

But realistically, what can you buy for $25 and will it make a genuine difference to struggling low-income families?

Food

A basic supermarket shop will vary from household to household but it does seem like $25 can go a long way.

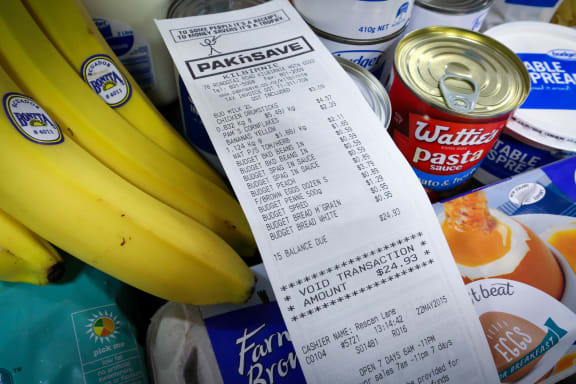

Radio New Zealand managed to buy the following items at Pak'nSave Kilbirnie for $24.93.

- Two litres of milk

- Chicken drumsticks

- Cornflakes

- Bananas

- Watties pasta sauce

- Two tins of baked beans

- Two tins of spaghetti

- Tin of peaches

- 12 eggs

- Penne pasta

- Margarine

- One loaf of white bread

- One loaf of multigrain bread

Pak'nSave's website provides meal ideas, including an Italian casserole that serves 10 people.

Presuming a household did not have any of the ingredients required for the meal - such as olive oil and onions - it would cost $34.83 to purchase everything on the list, or $3.48 per serve.

For a family of five, the meal would cost only $17.40.

So the extra money would, in this case, buy a family one hearty cooked meal.

Clothing

What $25 of clothing at The Warehouse will buy.

- Basic T-shirt = $4

- Basic sweatshirt = $12

- Girl's shoes = $2.49

- Leggings = $6

- = $24.49

Socks, singlets, gloves and scarves can all be purchased for less than $25.

At places like The Warehouse and KMart, basic children's clothing is very reasonably priced and $25 will go a long way.

Petrol

The AA PetrolWatch website shows Octane 91 prices in Auckland, Wellington and Christchurch are currently 204.9 cents to the litre.

So for $25, you could buy 12 litres of petrol or 19 litres of diesel, based on current prices.

Activities and treats

Family passes to swimming pools in Christchurch, Wellington and Auckland all come under the $25 mark.

Readings Cinema offers $10 tickets in some parts of the country.

If a family of four saved their welfare increases for two and a half weeks, they could visit Wellington Zoo.

Orana Park and Willowbank Wildlife Reserve in Christchurch are both budget-blowers.

Prices vary around the country but depending on age, two or three children could play at Chipmunks for less than $25.

Changes to benefits:

Families on the benefit will receive $25 extra a week from next April and, after allowing for higher accommodation costs, the Government estimates parents on a benefit will receive an average of $23 extra a week.

Because those families will be receiving more, those in state housing will pay an extra $6.25 a week, because their rent is set at 25 percent of their income, and those in private rentals will receive $4 less in their accommodation allowance.

About 110,000 families, with a total of 190,000 children, will get the extra payment.

The Government subsidy available for childcare will increase from $4 an hour to $5 an hour for up to 50 hours a week, per child.

However, there will be tougher work obligations, including:

- Beneficiaries receiving Sole Party Support will have to reapply for their benefit each year.

- Those on Sole Parent Support, or people whose partner is on a Jobseeker Benefit will have to be available for work when their youngest child turns three; at the moment it's when the youngest child turns five.

- All beneficiaries with part-time work obligations will now be expected to find work for an average of 20 hours a week, up from the current requirement of 15 hours a week.

Working for Families:

The base rate of the In-Work tax Credit will increase from $60 to $72.50 a week - an increase of $12.50 a week, or about 21 percent.

This means families earning $36,350 or less a year will get $12.50 extra a week; very low income families will get $24.50 extra.

Those earning more than $36,350 will get less than $12.50 a week, depending on their family income.

Families earning more than $88,000 will receive slightly less.

About 200,000 working families, with a total of about 380,000 children, will be affected.