Growth in digital media in New Zealand is continuing to massively outstrip spending on non-digital content.

Photo: Supplied

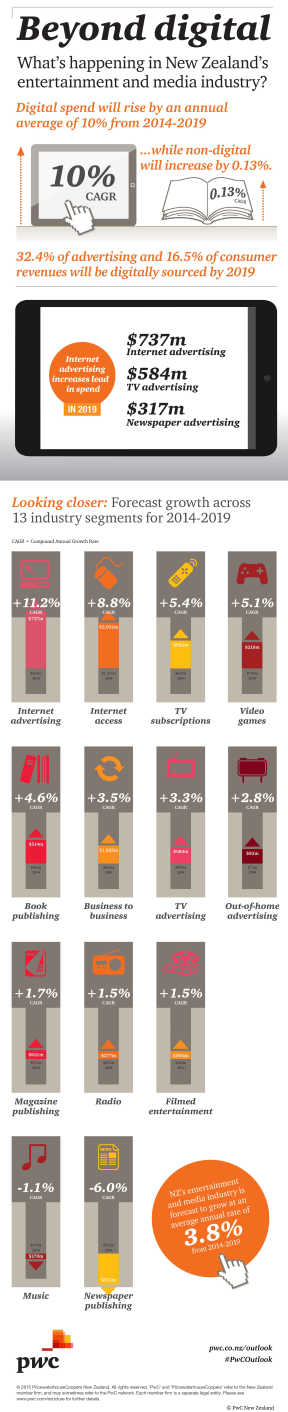

PricewaterhouseCoopers' latest insight into the media industry said spending on digital content was forecast to grow at 10 percent a year through to 2019.

Spending on non-digital content was tipped to rise by just 0.13 percent a year - better than last year's forecasts, which predicted an annual decline of 0.5 percent.

Digital advertising growth was being driven mainly by mobile devices, and internet advertising was expected to soar past advertising on television by 2017.

PricewaterhouseCoopers' digital strategy and data leader Greg Doone said it was clear New Zealanders wanted convenience with their media.

"Consumers never really regard any distinction between 'digital' and 'non-digital' as relevant," he said.

"They take on board the proliferation of content and access options enabled by digital, and exploit it to seek more flexibility and freedom in what, when and how they consume."

The outlook suggests one of the most visible shifts is in television and video consumption, with people increasingly demanding high-quality original programming on-demand across many devices, Mr Doone said.

"New Zealand's entertainment and media companies need to embrace the consumption experience as their critical success factor.

"What matters is the ability to combine content with a user experience that's differentiated and compelling on the consumer's platform of choice," he said.

PricewaterhouseCoopers predicted New Zealand's entertainment and media industry would grow 3.8 percent on average each year to 2019 - below the expected global growth rate of 5.1 percent.

It also said New Zealand newspapers had just 8 percent of revenue from digital channels, and they needed to work hard to keep their old customers and develop new income.

The outlook said the advertising take was expected to fall to $317 million by 2019, from $489 million last year.

Key expectations from the media outlook

- Book publishing - industry remains robust in New Zealand, e-book revenue will rise to 36 percent of total consumer books revenue by 2019.

- Magazine publishing - total magazine revenue will be $621m by 2019, up from $571m in 2014.

- Filmed entertainment - New Zealand's total revenue will be worth $584m by 2019, up from $541 in 2014. Cinema revenue will rise because of increased ticket prices.

- Internet advertising - reached $435m in 2014, market will be worth $737m by 2019. Mobile internet advertising revenue will more than triple.

- Newspaper publishing - New Zealand newspapers forecast to lose daily circulation, and raise cover prices. Advertising take is in "pronounced and ongoing shrinkage".

- Radio - advertising revenue accounts for the entire commercial radio market forecast to grow only modestly, from $257m in 2014 to $277m in 2019.

- Music - New Zealand's music market was worth $179m in 2014, down from $188m in 2013 and $209m in 2010. Expected to fall to $170m in 2019.

- TV advertising - expected to reach a new high of $584m in 2019.

- TV subscriptions - number of subscription TV households to rise from 915,000 last year to 1.2m by the end of 2019.