Opinion - Today's intense debate about the proposed capital gains tax shows more is at stake than just a tweak to the way the IRD goes about its business.

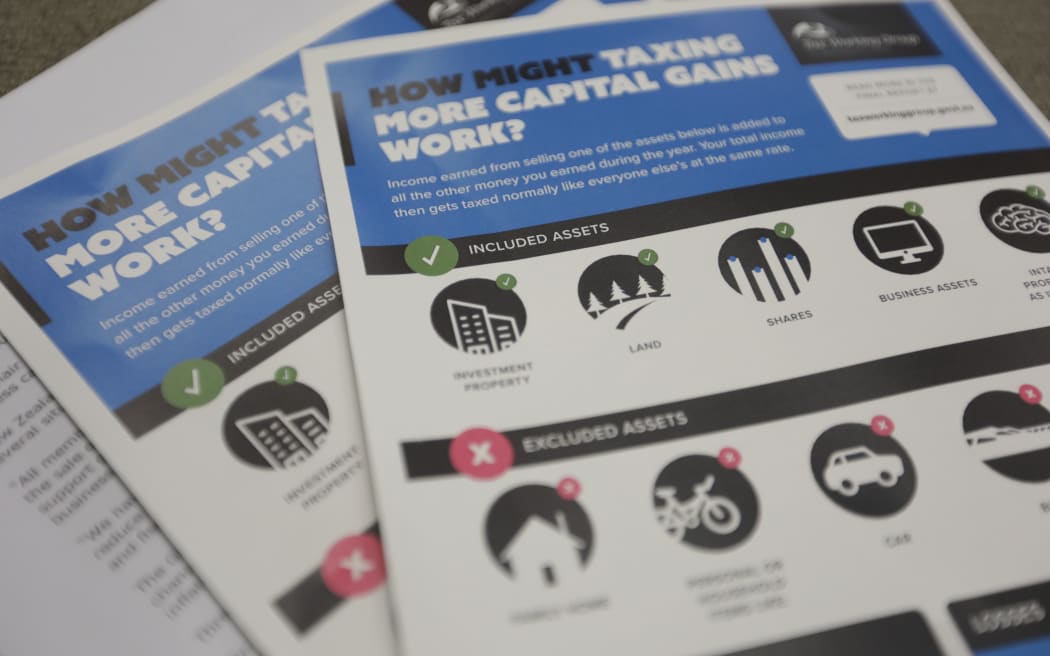

Papers at the release of the Tax Working Group recommendations. Photo: RNZ / Rebekah Parsons-King

For Jacinda Ardern, it is a test of her political nerve. Does she have the courage to make the case for something clearly important to her?

Some polls show support for the tax, others opposition: there is room at least for voters to be swayed.

It also calls into question Labour's political strategies.

Was it right to outsource such a big issue to a working group, allowing opposition parties to attack the idea for over a year while tieing the hands of ministers who might have returned fire?

But most of all the proposed tax is a test of the stories we New Zealanders like to tell about ourselves. Fairness and egalitarianism are supposedly our touchstones.

Yet we have allowed inequality in income - our salaries and wages - to soar to such a point that we are among the developed world's most unequal.

When it comes to wealth - the assets we own - our wealthiest tenth have 60 percent of all assets while the poorest half of adults have just 4 percent.

At the moment, that vaunted egalitarianism looks a lot like a myth. But a capital gains tax could make it something more real.

After all, how is it fair if someone who sells a house and makes $50,000 profit (after the cost of any improvements) will pay no tax on that transaction, while an office worker on $50,000 a year pays tax on every cent? A capital gains tax would also fall largely on the wealthiest fifth who own 80 percent of the relevant assets, reducing inequality.

From this viewpoint, a capital gains tax is essentially a fairness tax.

Fairer still would be a tax on gifts received - to compensate those not fortunate enough to inherit wealth - and a more thorough wealth tax that acknowledged the benefits people derive from their assets every year, not just at sale.

But a capital gains tax would nonetheless give some substance to the idea of egalitarianism.

The other key question about values concerns kindness, something by which the prime minister sets great store.

Looking out for others is the counterpart of fairness, and again we like to think we do well on this score, compared to larger and supposedly less friendly nations.

And we do express kindness to others in countless everyday ways, in our families, communities and workplaces.

But certain forms of kindness, those that involve helping fellow citizens we have never met, can be effectively carried out only by government. Into this category fall our public heath, education and welfare systems.

At the moment, government spending in New Zealand is limited - by the Budget Responsibility Rules and by political convention - to 30 percent of GDP, even while many European and Scandinavian governments spend 40 percent or more, with much lower rates of poverty and social problems as a result.

If Ms Ardern is really going to deliver more of this high-level kindness, she's going to need a more active government.

And that rather implies that instead of a capital gains tax being revenue-neutral - that is, matched by corresponding cuts in income tax - it should be purely revenue-raising, its funds used to restore high-quality public services and help those who struggle through no fault of their own.

This is the kind of thing that we like to think we do well, though in point of fact we don't. Hence why the debates on tax are so revealing about the New Zealand way of life - and the truth or otherwise of our national stories.

* Max Rashbrooke is the author of Wealth and New Zealand, and Government for the Public Good.