Analysis - It's often been remarked that capital gains tax is the shortest suicide note in New Zealand politics.

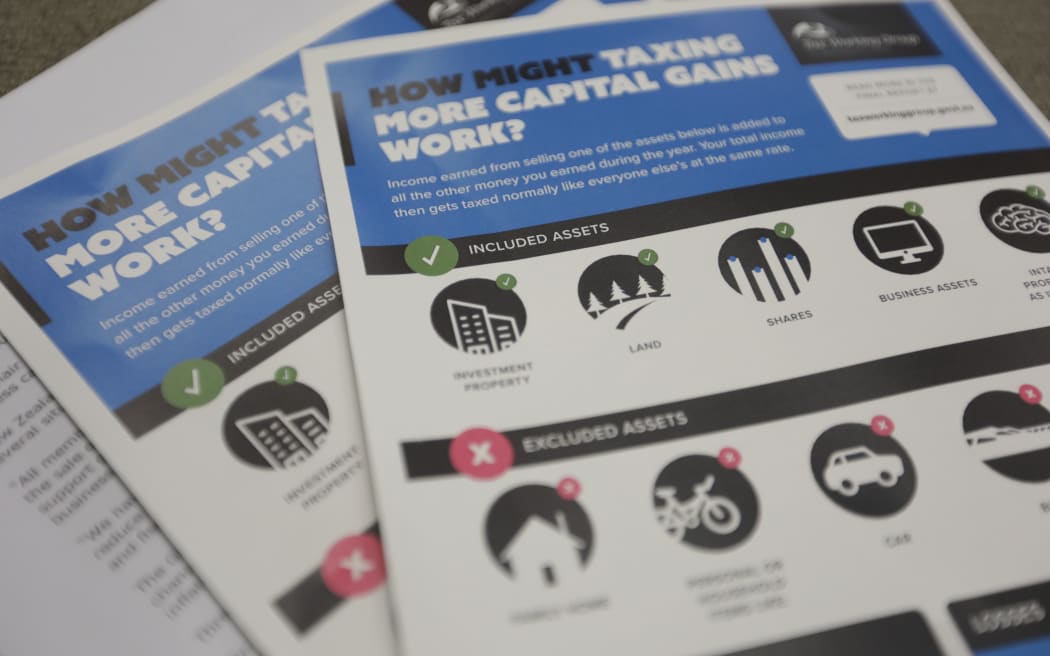

Papers at the release of the Tax Working Group recommendations. Photo: RNZ / Rebekah Parsons-King

Over the decades no government has been brave enough to grasp the nettle and so it is with the current administration.

"We will not be introducing a capital gains tax ... While I have believed in a CGT, it's clear many New Zealanders do not. That is why I am also ruling out a capital gains tax under my leadership in the future," Prime Minister Jacinda Ardern said.

The Tax Working Group (TWG) spared virtually no sector in its all embracing report of the - business, farm owners, retirement savings, and in time polluters and water users were all in the report's sights. The TWG recommended the tax be imposed at a taxpayer's marginal tax rate - their highest personal rate - which for many would have been 33 percent.

The family home was left sacrosanct, but the one issue the 11 person TWG unanimously agreed on was a capital gains tax on the sale of property other than the family home, with some exemptions for the passing of the family bach and farms between family generations.

After that the TWG split, with three members disagreeing with the majority on most other matters and issuing their own minority report.

The offset for the CGT was the recommendation to raise the tax thresholds, effectively a tax break, so low and middle income earners would pay a lower tax rate on more of their income.

Overall the TWG calculated its various proposals would bring in about $8 billion, over time, which it planned largely to recycle through other changes, such as raising thresholds. Business groups put a loose price tag of $1.8b to $6b of costs from any CGT.

Prime Minister Jacinda Ardern announced on Wednesday afternoon that the Capital Gains Tax won't be introduced. Photo: RNZ / Rebekah Parsons-King

It's politics, stupid

But tax issues are usually more politics than equity and fiscal issues.

Within a week of the TWG report the government was back-pedalling, with the Prime Minister saying farmers and small business people would be top of mind.

In the end the clout of New Zealand First and no-doubt some nervous Labour backbenchers has prevailed.

"All parties in the government entered into this debate with different perspectives and, after significant discussion, we have ultimately been unable to find a consensus," Ms Ardern said.

The Greens will have to be pragmatic and accept the rebuff.

"Taxing income from capital the same way we tax income from work would reduce the wealth gap, fix the housing crisis and build a more productive, high-wage economy," co-leader James Shaw said.

The government asked for honest debate and then left the chair of the TWG, Sir Michael Cullen, at the cost of $1,000 a day, to counter the political and business opposition.

Devil in the detail

The problem for the capital gains tax has always been trying to present it as fair and equitable.

The opposition loudly asked where was the equity in a single home owner selling their upmarket home in Auckland or Queenstown, for millions in tax free capital gains, but penalising the hard done by, struggling "mum and dad" investors with a rental property bought for their retirement.

Tax Working Group chairman Sir Michael Cullen. Photo: RNZ / Richard Tindiller

That support for the 'kiwi way of life' ignored the fact, much of the capital in those investments was bank finance at low interest rates, with a few favourable tax perks as well.

There are about 1.8 million homes in New Zealand, with nearly 1.2 million owner-occupied and about 600,000 being rentals. But many investors own more than one property - as a look at the assets of MPs in the pecuniary interests register confirmed.

Using Stats NZ data a capital gains tax on properties other than the family home might affect fewer than half a million people. So why bother?

The proposals to hit the capital gains on the sale of businesses and farms, with exemptions, and to change the taxation of New Zealand and Australian shares, key parts of Kiwisaver accounts share trading, were never properly argued nor promoted.

"A capital gains tax would have worsened the business environment, dis-incentivised owners from growing their businesses, and greatly increased compliance costs," Business Central chief executive John Milford said.

Is tax reform dead?

Perhaps not, but it will be a shadow of what might have been achieved from the TWG report.

The government looks set to to pursue its tax plan for a digital tax on big online businesses such as Facebook, Amazon, and Google, which earn large amounts here but pay minimal tax.

The Prime Minister said it will look at ways to curb land speculation, land banking, and cut red tape.

And it looks set to use the TWG report for possibly developing niche taxes, which might be used to tackle future environmental issues.

"The Tax Working Group was a valuable exercise that has delivered some useful suggestions well beyond just the debate on CGT... In fact the majority of recommendations will either be investigated further or have formed part of our work programme," Ms Ardern said.

So, watch this space, but not too closely and probably not for some time.