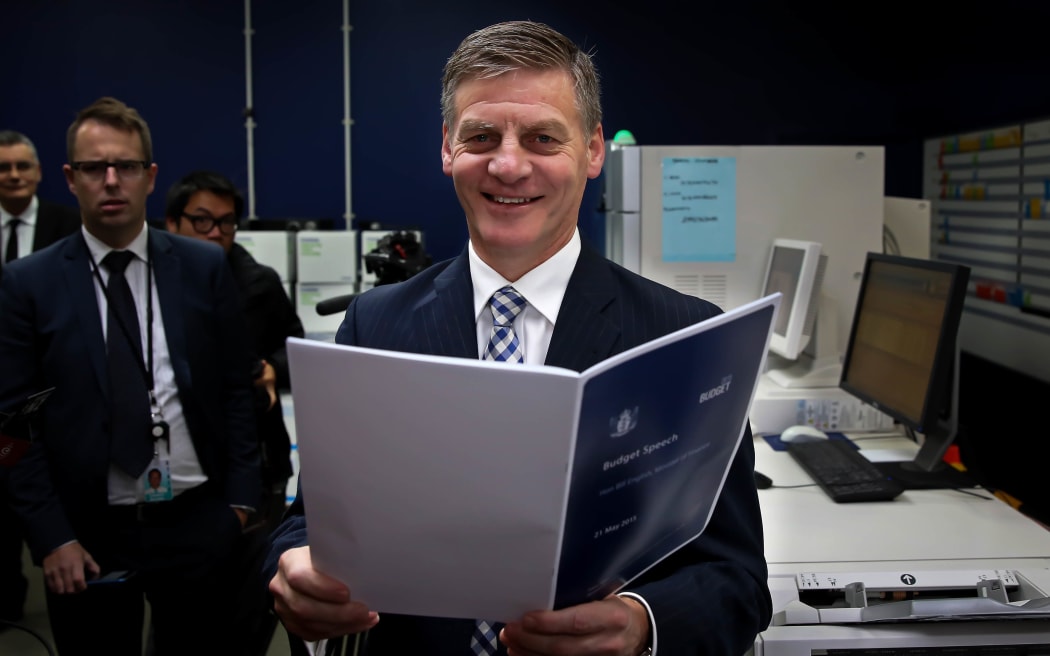

Power Play - Finance Minister Bill English was unusually optimistic when he delivered his last Budget.

After years of running budget deficits and talking about the impact of recession and the Canterbury earthquakes Mr English was looking forward to managing the economic recovery.

Bill English picking up the 2015 Budget at the printers in Petone, Lower Hutt. Photo: RNZ / Alexander Robertson

Things were looking good. Commodity prices were high and the economy was growing. At last the Government could shrug off the pessimism of recession.

But that was a year ago.

Here's what Mr English said then in delivering his sixth Budget.

"It's a particular privilege because this is the first Budget in six years to focus on managing a growing economy rather than recovering from a domestic recession and then the global financial crisis."

He was forecasting a surplus this financial year.

Bill English delivering his 2014 Budget to Parliament. Photo: RNZ / Diego Opatowski

On Thursday he will dump that forecast as the public finances have not improved as markedly as he or his advisers had expected.

In last year's Budget Mr English was not unrealistic.

He did warn the economy would start to face some problems.

"The Government is taking a long-term view of economic growth because some of the factors driving the economy today will peak over the next few years.

"Export prices are likely to return closer to normal levels, housing supply will eventually catch up and the Christchurch rebuild will peak and eventually slow," he said then.

What Mr English did not know was that dairy prices would crash below normal levels and do so more quickly than anticipated.

And rather than rebounding as the Treasury hoped they kept on going down. That is putting a large hole in the economy and consequently the Government's books.

Together with lower-than-expected inflation, which perversely means the Government collects less tax, it is now estimating a drop in its forecast tax take.

In a pre-Budget speech to the Wellington Employers Chamber of Commerce Mr English said the Treasury was now forecasting nominal economic output over the next four years to 2019 to be about 1.5 percent lower than forecast in last year's Budget.

He said that was the equivalent of a $15 billion drop in economic output, or about half the impact of the Global Financial Crisis.

As a result the Government would now collect $4.5 billion less in tax over the next four years than it forecast last year.

So when Mr English walks into Parliament on Thursday afternoon to deliver his seventh Budget he might not be as optimistic as 12 months ago.

But he will take credit for controlling spending.

He said in his pre-Budget speech that government spending this year was expected to be about $73 billion, nearly $4 billion lower than forecast in 2011 when the Government first said it would be in surplus by 2014-15.

Yet Mr English still has to deal with significant problems, not the least of which is the ongoing boom in Auckland housing.

While the Minister spoke positively last year about the supply of housing in Auckland eventually catching up with demand there is, as yet, no sign of that happening.

Last year Mr English had this to say about the housing situation in Auckland.

"The Government has taken a number of steps to free up housing supply, which is essential to improving affordability. These steps include signing housing accords with Auckland and Christchurch councils, with the latter subject to consultation."

He also listed a number of other initiatives promoted by the Government, including removing duties and tariffs on building materials used to build a standard house.

But there was no sense of urgency.

Mr English and the Prime Minister, John Key, continue to reject suggestions that rising house prices in Auckland represents a crisis.

Yet Thursday's Budget might reflect growing government recognition that it is a serious problem which, if left unchecked, could turn into a housing bubble and that would be a crisis.

Follow Brent Edwards on Twitter @rnzgallerybrent