China's economy grew by 6.7 percent in 2016, compared with 6.9 percent a year earlier, according to official data, marking its slowest growth since 1990.

Photo: Zhengyi Xie / NurPhoto

The figure is in line with Beijing's growth target of between 6.5 percent and 7 percent.

But the news comes just a couple of days after the leader of one Chinese region admitted GDP data was faked.

China is a key driver of the global economy and a growth slowdown is a major concern for investors around the world.

'Deception'

Some analysts have taken heart from data showing growth in the last three months of 2016 was at an annual rate of 6.8 percent - a slightly faster pace than the rest of the year.

But many observers have been saying for a long time that the country's growth was actually much weaker than the official data suggests.

And those beliefs gained more support this week, when the Governor of Liaoning, Chen Qiufa, said his province had been "involved in a large-scale financial deception" between 2011 and 2014, and that economic data had been doctored.

China is the world's second-biggest importer of both goods and commercial services, meaning its economic performance has a big knock-on impact around the world.

It plays an important role as a buyer of oil and other commodities, and its slowdown has been a factor in the decline in the prices of such goods.

Beijing's aim to rebalance the economy towards domestic consumption has led to major challenges for large manufacturing sectors, and there have been layoffs - especially in heavily staffed state-run sectors such as the steel industry.

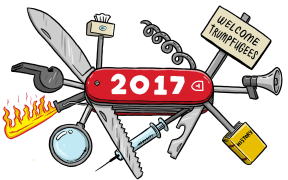

Trump effect?

Although China's economy picked up slightly in the last three months of 2016, the rebound is not expected to continue, according to the Economist Intelligence Unit (EIU), which is predicting growth of 6.2 percent this year.

"A slowdown in the property market and steps to address supply shortages in the commodity sector ought to drag again on demand and output," said the EIU's Tom Rafferty.

He also pointed to potential damage to US-China trade ties under a Donald Trump presidency.

Meanwhile Tim Condon from ING in Singapore said relations with a Trump administration were "the biggest known unknown".

"Trump advisers and cabinet-nominees have identified the US-China relationship as in need of adjustment to support the president-elect's objective [of] a manufacturing renaissance."

Mr Trump had often accused China of manipulating its currency - the yuan, also known as the renminbi - on his presidential campaign trail.

Washington had also criticised China's yuan devaluation, saying it unfairly favoured Chinese exporters.

Allowing the currency to appreciate was "the path of least resistance for the world's most important bilateral economic relationship" said Mr Condon - despite the downside for Chinese exporters.

The trade of goods and services between US and China amounted to an estimated $US659 billion in 2015, with the US trade deficit with China totalling $US336bn.

- BBC