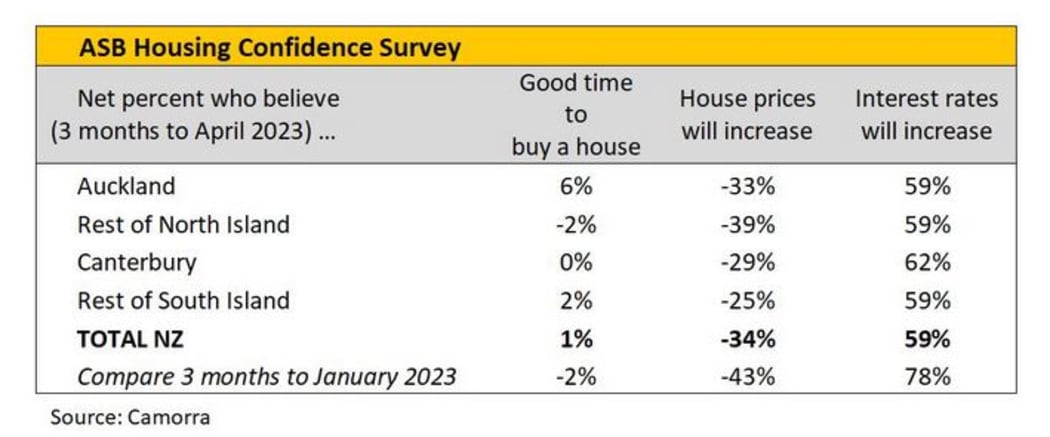

The ASB survey for the three months to April showed a net 34 percent of respondents expected house prices to continue to fall over the next 12 months. Photo: RNZ / Nathan Mckinnon

Confidence is beginning to return to the housing market, but most buyers and sellers remain on the fence.

ASB's latest Housing Confidence survey for the three months to April showed a net 34 percent of respondents expected house prices to continue to fall over the next 12 months, compared with a net 43 percent in the prior quarter.

In a statement, ASB Economist Nathaniel Keall said confidence increased but remained very low, with Aucklanders the most confident - a net 6 percent agreeing it was a good time to buy property.

"It seems the housing market is moving into more lukewarm territory, but we're still a long way off the red-hot days of 2020 and 2021," Keall said.

ASB Housing Confidence Survey results at a glance. Photo: Camorra

The survey indicated the majority of New Zealanders (net 66 percent) were not convinced the property market had found its floor, but an increased number thought it was close.

A growing number also expected home loan rates were near their peak, though more than half (net 59 percent) still expected further interest rate rises.

"It remains a tricky environment to predict what's next for interest rates and house prices, and this uncertainty comes as many New Zealanders are doing it tough in terms of managing their mortgage repayments and housing affordability," Keall said.

"This quarter's result doesn't capture the dramatic shift in migration figures, the 2023 Budget or the RBNZ's [Reserve Bank of New Zealand] last monetary policy statement, which will all be key watchouts for the next quarter.

"We don't expect any further OCR [official cash rate] hikes from here, suggesting mortgage rates are at or around their peak. But we do agree it's sensible to be budgeting on rates remaining at these levels for some time to come, with OCR cuts unlikely before mid-2024."

A shift in price expectations was reported throughout the country, but was more pronounced in the South Island, where house prices may have already turned, as indicated by recent Real Estate Institute data.