The Crown says the Treasury was in the dark about the state of South Canterbury Finance when it allowed the company to be covered by the Government's Retail Deposit Guarantee Scheme which ended up costing taxpayers $1.6 billion.

Former SCF chief executive Lachie McLeod and former directors Edward Sullivan and Robert White are facing 18 fraud charges in the High Court at Timaru including theft by a person in a special relationship, false statements by a promoter, obtaining by deception and false accounting.

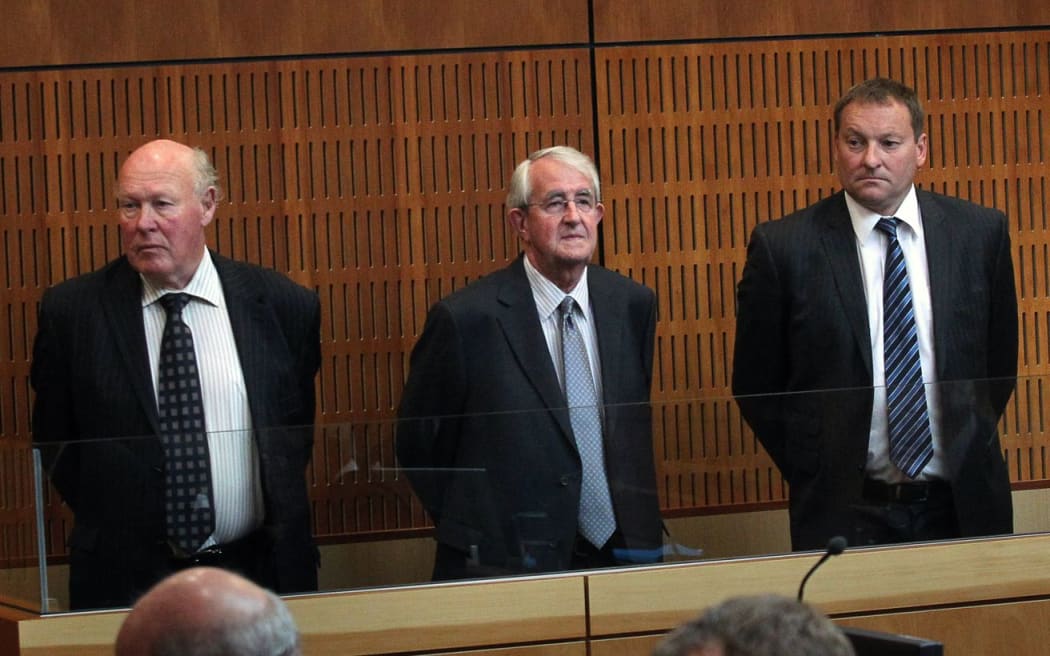

From left: Edward Sullivan, Robert White and Lachie McLeod. Photo: Mytchall Bransgrove

The company collapsed in 2010 owing investors $1.7 billion, which makes the case New Zealand's biggest fraud trial.

In continuing to open the Crown's case on Thursday, Colin Carruthers, QC, referred to the Retail Deposit Guarantee Scheme under which the Government paid SCF investors $1.6 billion.

Mr Carruthers read out a 2008 letter from Robert White to Edward Sullivan in which Mr White expresses reservations about entering the scheme because of the need to make undertakings to the Treasury that everything being done at the company was above board.

Mr White writes of company founder Alan Hubbard failing to grasp the problem and his belief that, because what they were doing was for the benefit of the company's investors, it would be fine to go ahead and enter the scheme. Mr Hubbard died after a road accident in North Otago in 2011.

More evidence was heard about companies the directors set up to help hide risky loans SCF was making - described by Mr White as 'here we go around the mulberry bush'- type transactions.

Justice Heath asked Mr Carruthers whether it mattered to investors that they may not have had the full picture when they decided to invest, due to the fact their investments were covered by the Retail Deposit Guarantee Scheme.

In response, Mr Carruthers said they were affected because, among other things, the scheme was only in place for two years and failed to capture those with deposits on five-year terms.

'Culture of obfuscation'

On Wednesday Colin Carruthers opened the Crown's case by describing a culture of obfuscation at South Canterbury Finance.

Mr Carruthers read out an email from Mr White to Mr Sullivan in which Mr White concedes he's having trouble unravelling Mr Hubbard's accounts for Southbury Group, which received hundreds of millions of dollars in loans from the finance company.

Mr White says that after an afternoon of trying to work out the smoke and mirrors he has thrown in the towel.

Mr Carruthers read another email in which Mr White describes financing agreements reached with Alan Hubbard as being more about continuing to hide a pea under the thimble than anything.

The Crown finished summing up its case on Thursday. An application to have Justice Heath remove himself because of a perception of bias towards the Serious Fraud Office will be argued in court on Monday.

The trial, which is being heard in front of a judge alone, is set down for four months.