The data is clear: economists' forecasts are often wrong. Given their track record, shouldn't these prognostications come with more caveats and disclaimers when they're broadcast by the media?

Photo: photo/ RNZ Mediawatch

In April last year, independent economist Cameron Bagrie went on Morning Report with a startling prediction.

"This downturn, recession, is looking a hell of a lot worse than what we experienced during the Global Financial Crisis. As a starting point, I'd pencil in house prices down at least 10 percent," he said.

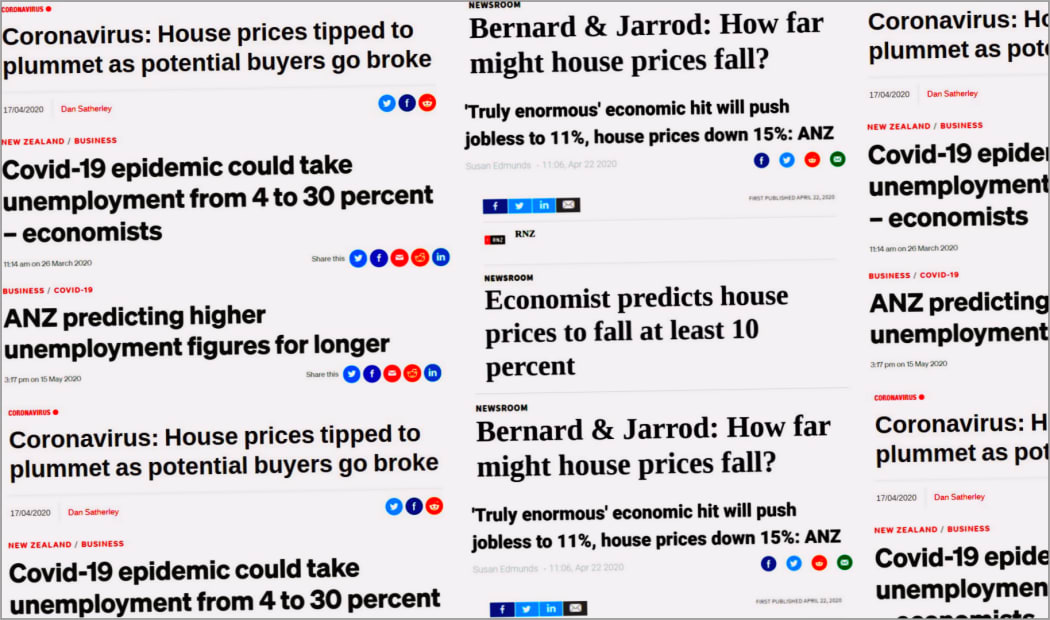

Bagrie was far from alone in that projection.

Many of our best-known bank economists forecast a declining property market as the Covid crisis deepened last year.

In April, ANZ forecast a 10 to 15 percent drop in house prices. Kiwibank's Jarrod Kerr predicted a 10 to 20 percent dip.

We know the rest of the story: prices rose about 20% in 2020, and kept going up.

In June this year, 1News presenter Chris Chang opened a segment on property prices with the news they'd risen 30 percent in the last 12 months.

Economists’ unemployment forecasts followed a similar trajectory.

In May last year, ANZ chief economist Sharon Zollner said the government was being optimistic projecting unemployment to return to pre-Covid levels by 2025.

"We do see it lifting up to 11 percent, which is not that much higher than the Treasury has it, and then holding up longer," she said.

In a story angled around economists' increasing optimism the following month, Westpac chief economist Dominick Stephens still projected a deep recession.

"Most people's personal experience of it is going to get worse from here. The unemployment rate is going to continue rising. Business is probably going to get tougher. There are going to be more layoffs, and there's going to be a big recession."

Again, these predictions have so far proven to be off-target.

Unemployment peaked at just over 5 percent in September last year, and has since dropped to 4.7 percent.

Now economists like Cameron Bagrie say the government has a very different dilemma: how to deal with the inflationary pressures caused by so many people having jobs.

Cameron Bagrie Photo: RNZ / Alexander Robertson

"The economy is reaching the capacity constraints. That's an environment when inflation is going to be moving up and by any benchmark it looks like we're at full employment - maximum sustainable employment. There's pressure for the Reserve Bank to turn down the heat," he told Morning Report earlier this month.

You might argue Mediawatch is being a little unfair here. Covid was a global cataclysm that precipitated a whole bunch of unpredictable events. Lots of people got things wrong.

Except these sorts of misfires are hardly uncommon.

Economists have long proven to be bad at predicting recessions.

One 2018 study looked at 153 recessions in 63 countries between 1992 and 2014 and found the vast bulk of them came as a surprise to economists.

The Queen famously asked why nobody noticed the 2008 Global Economic Crisis coming.

In his acceptance speech for the Nobel prize for economics, Friedrich Hayek said economists' tendency to predict things with the certainty and language of science was misleading and “may have deplorable effects”.

At home, the Reserve Bank has repeatedly forecast that interest rates are set to go up over the last decade, only for them to stubbornly keep going down.

Sense Partners economist Shamubeel Eaqub says he's given up forecasting due to its futility.

"I don't do that stuff anymore. I don't do forecasting anymore because I know that I don't know how to forecast."

Eaqub has some harsh personal experience in this area. He predicted unemployment could rise to between 15 and 30 percent during the early months of the Covid crisis.

He says the media needs to get better at recognising economists’ limitations, and ease off on asking them for their predictions.

Cameron Bagrie - ANZ Chief Economist Photo: RNZ / Alexander Robertson

"A random number generator is not that far off economists' forecasts," he says.

"There is no accountability to the forecasts that are made. We've got the data that shows the things you ask us to talk about - house prices, interest rates, the exchange rate, the economy - more often that not you'll find we get the direction, the magnitude, and the timing wrong."

Economic journalist Bernard Hickey has also been burned by the forecasting game.

In 2008, he predicted Auckland house prices were about to drop 30 percent. Auckland’s median house price has risen about 117 percent since then.

He says media organisations could do with sounding a note of caution before economists deliver their on-air prognostications.

"You always forget how wrong people were in the past. You're very focused on the right now. I would like to put some context and perspective into these things."

Bad economic predictions can have real-world consequences, Hickey says.

Many people have decided what to do with their mortgage based on inaccurate predictions of interest rate rises from the Reserve Bank and other economists over the last decade, he says.

"A lot of people have fixed for long terms on those predictions and then when it hadn't turned out right, they've had to break those long-term fixed mortgages, and that's been quite expensive."

It’s possible to eke out some sympathy for these economists.

The economy is vast, complicated, and confusing, and as a result easy to be wrong about.

But their predictions, often made with unwarranted, unshakeable confidence, have real impacts on people’s financial futures.

Given the amount they’re wrong, it’s worth adding a disclaimer before printing or broadcasting their opinions: this could be right, but definitely don’t bet your house on it.